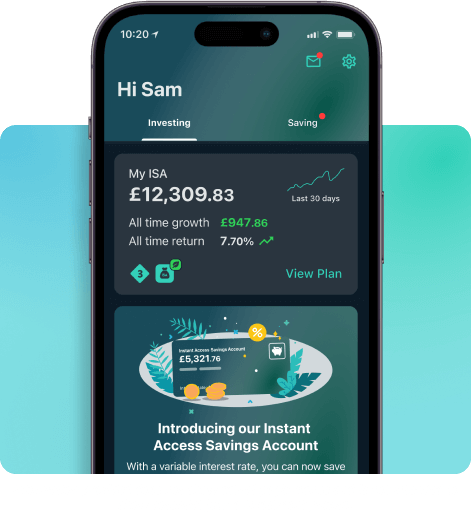

Welcome to Wealthify

Your easy way to manage your money online or on our app.

- Simple choice of investment styles built around you and expertly managed

- No-limit ways to grow your cash savings with competitive rates

- A low-cost home for you to bring your old workplace pensions under one roof

With investing, your capital is at risk. Tax treatments depend on your individual circumstances and may change in the future.

SAVE. INVEST. BUILD YOUR FUTURE WEALTH.

Whether you're saving regularly or investing ethically, we've built a range of award-winning products to help you achieve your financial goals.

STOCKS AND SHARES ISA

JUNIOR STOCKS AND SHARES ISA

SELF-INVESTED PERSONAL PENSION

GENERAL INVESTMENT ACCOUNT

INSTANT ACCESS SAVINGS ACCOUNT

WHY CHOOSE WEALTHIFY?

From rainy days to special days; unexpected bills to poolside chills; your financial piece of the pie to peace of mind: Wealthify is about so much more than just ‘putting money away’.

With a range of products for people at every stage and from all walks of life, it’s about the confidence that comes with being prepared for the worst — and satisfaction of knowing that building your future wealth is always for the best.

Using our simple, award-winning app or website, start from as little as £1 (£50 for Pensions), then let us look after everything for you.

Because Wealthify is for people who want more from their finances by doing less; people who value their time just as much as their money.

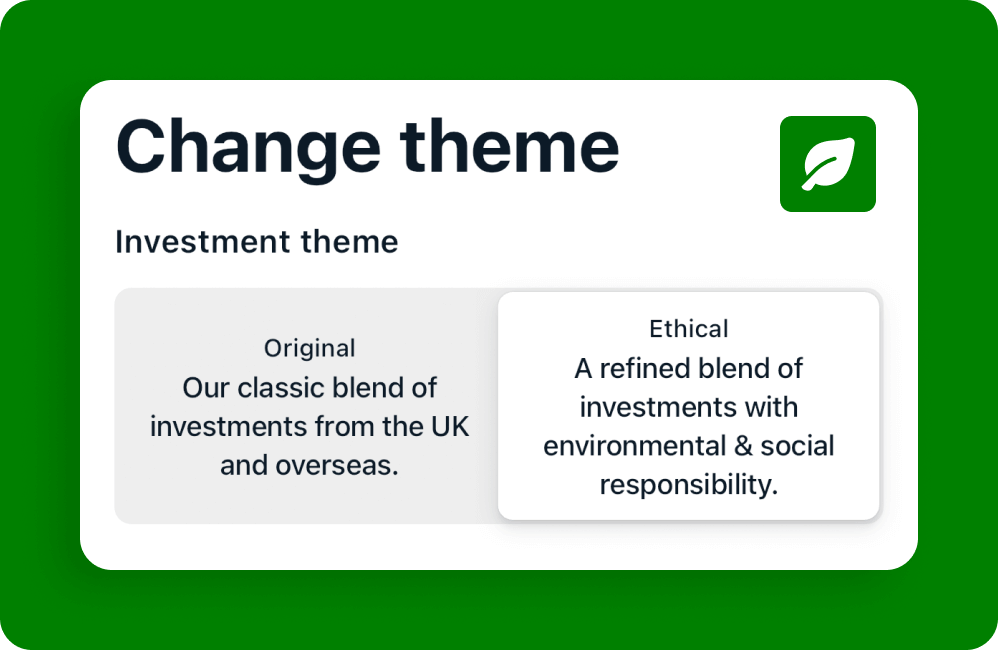

STAYING TRUE TO YOUR VALUES

With Wealthify, investing for your future also means being able to invest in the planet's future at the same time.

That's why we've joined forces with best-in-class ethical fund providers, to create five Ethical Plans that let you invest in organisations committed to having a positive impact on society and the environment. All our fund providers are signatories of the Principles of Responsible Investing (PRI), the world’s leading proponent of responsible investing.

With the actively managed ethical funds employed in our Plans, they keep a close eye on the organisations they invest in — employing rigorous, ongoing screening to ensure ethical standards are maintained.

Awards

We're really proud of all the awards we've won since launching in 2016; not because we enjoy the recognition, but because it means we're doing something right (and that our customers are happy). These awards also help spread the word about Wealthify — meaning other people can start enjoying it, too!

KEEPING YOUR MONEY SAFE

We know the only thing more important than making your money work harder, is making sure it’s safe — here’s how we take care of yours.

Secure

Your login details will always be kept secure – but never shared with anyone else.

Support

Our friendly Customer Care Team are always happy to help via email, Live Chat, or on 0800 802 1800.

Strength

Wealthify is owned and backed by Aviva: one of the UK's largest financial institutions.

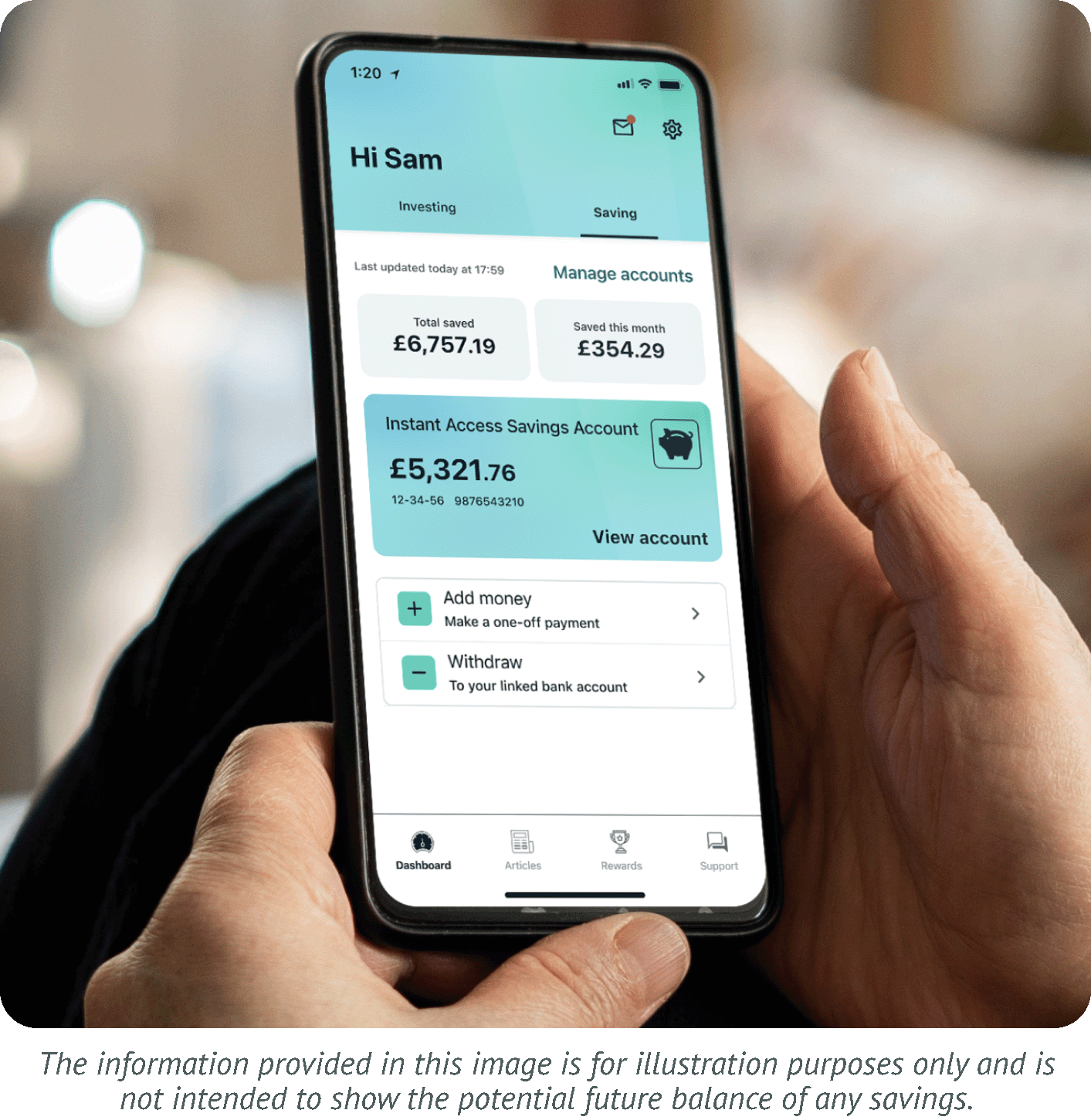

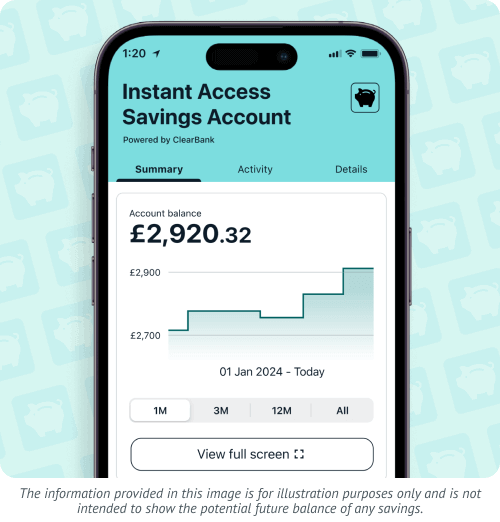

GROWING YOUR SAVINGS

INSTANT ACCESS SAVINGS ACCOUNT POWERED BY CLEARBANK

The current interest rate: 4.13% AER / 4.05% gross p.a. (variable). The interest rate tracks the Bank of England base rate minus a margin (currently 0.45%).

Our Instant Access Savings Account provides a variable interest rate, meaning the rate can go both up and down; if you’re after the certainty of a fixed interest rate, then this type of savings account might not be for you.

- Start saving from just £1, with no upper limit.

- Access your money instantly, with no limit on withdrawals.

- No fees for withdrawing your savings.

Wealthify, in collaboration with ClearBank, are providing you with an Instant Access Savings Account. Wealthify will provide the day-to-day servicing of the account (including being the point of contact for any questions you may have), with ClearBank providing the account itself.

INVESTING FOR THE LONG-TERM

Regardless of your knowledge and experience, we've made the process of investing with Wealthify as simple as possible. All you have to do is choose your investment product, style (from Cautious to Adventurous), and theme (Original or Ethical) — then just let our team of investment experts manage everything else for you!

With investing, your capital is at risk. Tax treatment depends on your individual circumstances and may change in the future.

STOCKS AND SHARES ISA

The Wealthify Stocks and Shares ISA (Individual Savings Account) is a great way for UK residents to invest, with no capital gains tax or income tax to pay on your money as it grows.

- Invest up to £20,000 tax-efficiently each year.

- Invest from as little as £1; withdraw your money at any time without penalty.

- Your Investment Plan is built and managed by our team of experts.

General Investment Account

General Investment Accounts (GIAs) are a great option if you've used up your annual ISA allowance, but still want access to diversified portfolios built and managed by our experts.

- Start a GIA from as little as £1.

- No limit on how much you can invest annually.

- Withdraw your money at any time without penalty.

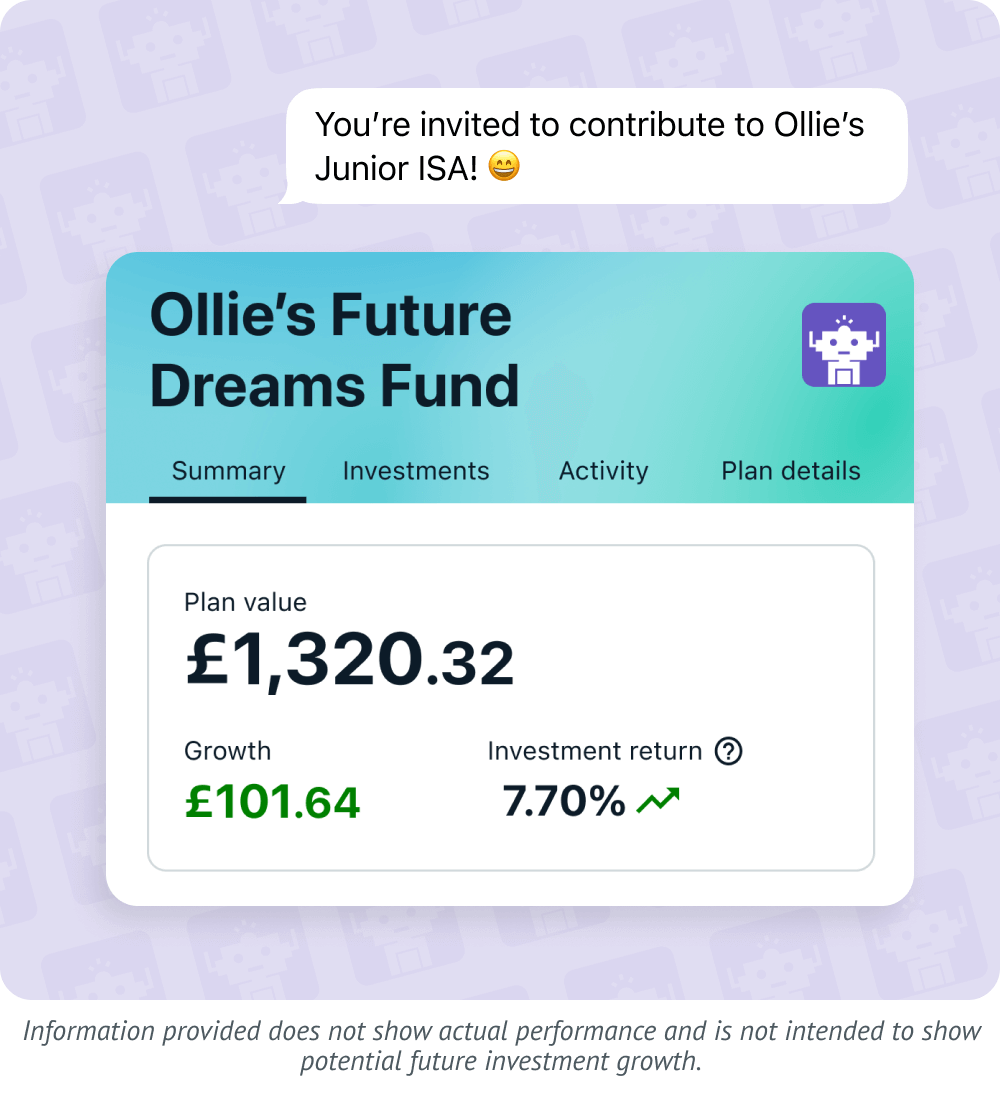

SHAPING YOUR CHILD'S FUTURE

JUNIOR STOCKS AND SHARES ISA

A Junior Stocks and Shares ISA (JISA) is a long-term, tax-free investment account that helps you provide a financial future for your little one.

- A tax-efficient way to save up to £9,000 every year for your child.

- Allow family and friends to contribute directly to your child’s JISA.

- Easily transfer another Junior Cash ISA or Child Trust Fund to your Wealthify JISA.

With investing, your capital is at risk. Tax treatment depends on your individual circumstances and may change in the future.

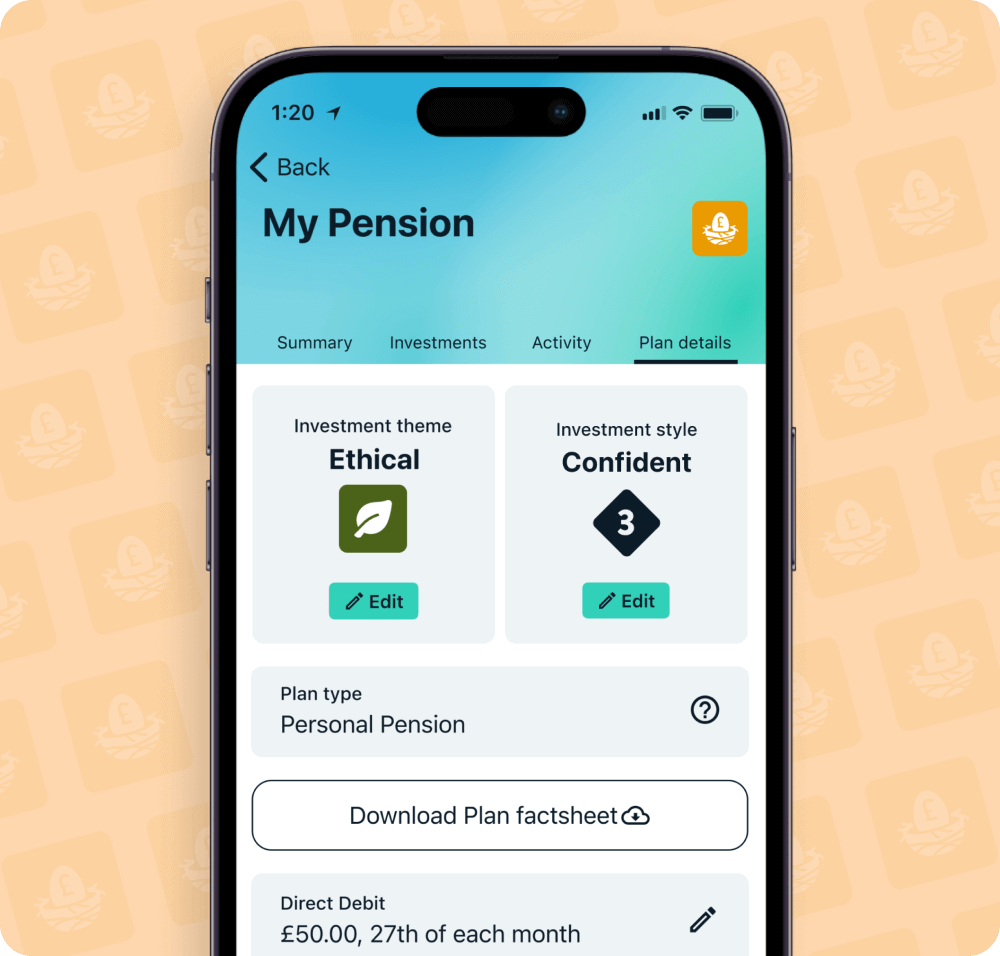

CREATING YOUR PENSION POT

PERSONAL PENSION

Wealthify’s Personal Pension is a great way to take more control over your future wealth, helping your money work harder.

- Combine previous pensions into one handy pot.

- Provides multiple investment options to suit your needs.

- All investments are managed for you by our team of experts.

With investing, your capital is at risk. Tax treatment depends on your individual circumstances and may change in the future.

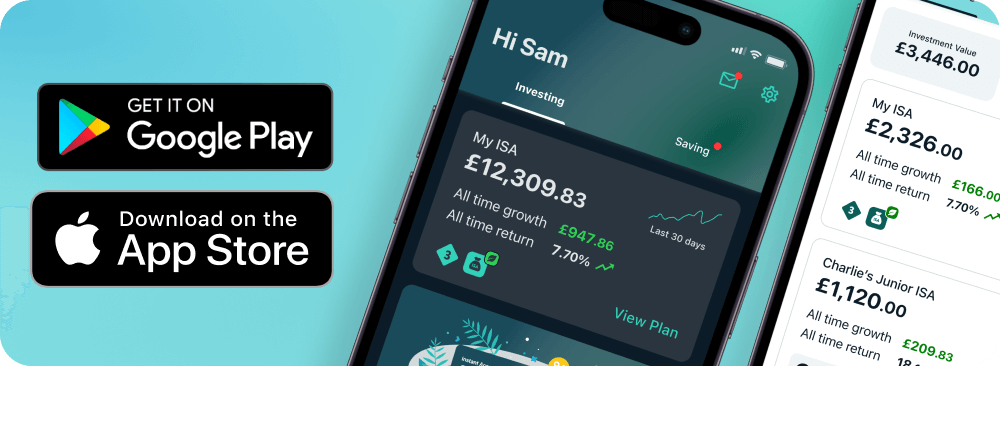

DOWNLOAD THE APP

Whether you’re looking for an investment app or money saving app, our award-winning wealth platform is available to download on iOS and Android devices (mobile and tablet). Built with security in mind, the Wealthify app is compatible with Face ID and Touch ID enabled handsets, making it an option for all your saving and investment planning.

STRENGTH IN DEPTH

We’re backed by Aviva, one of the UK’s largest financial services institutions which has looked after British consumers for more than 325 years.

Wealthify operates independently but Aviva own a majority shareholding, which means you get the best innovation in smart simple investing together with the security of knowing that we’re here to stay and operate to the highest standards.

Aviva’s investment in Wealthify allows us to achieve all the things we always wanted to, but at an accelerated pace and with greater confidence.