Pension Transfer

Transferring your old pensions to Wealthify couldn’t be simpler and comes with a whole host of benefits:

✓ Low annual management fee of 0.6% per year which includes the expert management of your Plan, taking the hassle out of saving for retirement

✓ When your pot reaches £100,000 get a reduced fee of 0.3% on any balance above that, meaning you get to keep more of your money

✓ Manage your pension online or on our award-winning app

The value of your pension could go down as well as up. Tax treatments depend on your individual circumstances (and could change in the future)

How to transfer your pension

The transfer process usually takes 2-6 weeks and our customer care team will be on-hand to support you with any questions you may have.

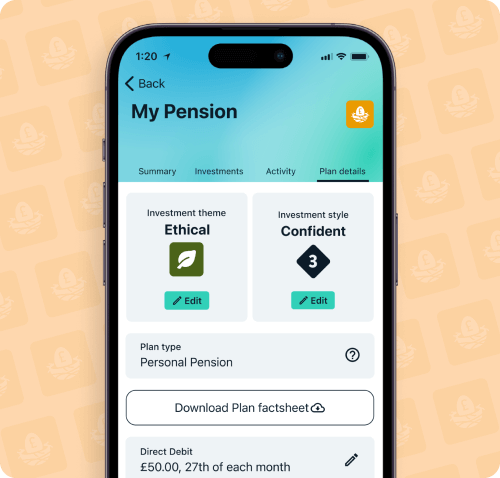

Set up your account

Use our Pension Plan creator to choose from 1 of 5 investment styles and see how much your pension could be worth.

We will help assess your suitable risk level with a few questions about your attitude to money.

Enter pension details

You will need your existing pension provider name, account reference number, and the approximate value of your pension.

Add as many pensions as you want if you are looking to consolidate pensions.

Leave it to us

Simply authorise your pension transfer to allow us to contact your existing provider, to transfer your pension's current cash value ready for us to invest into your new Wealthify Pension Plan.

Awards

Since 2016, we've been looking after our customers' hard-earned money and have picked up over 60 awards along the way.

"Wealthify have been superb for my pension...

Wealthify have been superb in bringing my multiple modest pension pots together. They were really helpful when one pension provider was unresponsive. Using Welathify has led to a much better return on my investment than would have happened without their pension product. I also like how they communicate what's happening with the fund and why the investment strategy changes. I feel my pension is in excellent hands."

Jessica

"Great pension service...

Moved some pensions together and have not looked back... the new pension is growing steadily. I have and will continue to recommend. From feeling a little lost and out of control to very in control, a very useful app so everything is at your finger tips."

David

"A trustworthy company and experts in their field...

I love the way they continually keep you up to date with what they are doing to maximise your Pension"

Marc

"Pension transfer perfect solution...

Transferred some old pensions. Quick and easy process. Saved on charges and all in one place now"

Christine

Strength in depth

We’re backed by Aviva, one of the UK’s largest financial services institutions which has looked after British consumers for more than 325 years. This means you get the best innovation in smart simple investing together with the security of knowing that we’re here to stay and operate to the highest standards.

Wealthify operates independently from Aviva, and our Pension Plans are made up of funds chosen by our own experts.

How have Wealthify Investment Plans performed?

The graph below shows how each of our investment styles - from Cautious to Adventurous - have performed between 29th February 2016 and 31st December 2025, after all fees have been taken (based on 0.60% p.a. Wealthify management fee). These figures are based on the performance of Plans worth more than £100, figures will be different for Plans below that amount.

Original

Ethical

Of course, we experienced the ups and downs of the market along the way and you could get back less than you put in. Although we cannot rely on past performance to predict future results investing for the long-term (5 years or more) typically delivers positive returns. These figures are after all fees have been taken (based on 0.60% p.a Wealthify management charge), and are based on the performance of Plans worth more than £100 and will be different for Plans below that amount.

Original Plan performance by year

This table shows by how much each of our investment styles have grown each year

| Investment Style | 31/12/2019 - 31/12/2020 | 31/12/2020 - 31/12/2021 | 31/12/2021 - 31/12/2022 | 30/12/2022 - 30/12/2023 | 29/12/2023 - 29/12/2024 | 30/12/2024 - 30/12/2025 | |

|---|---|---|---|---|---|---|---|

| Cautious | 2.70% | 0.47% | -11.19% | 4.65% | 1.05% | 6.08% | 6.08% |

| Tentative | 3.88% | 3.72% | -10.82% | 6.21% | 3.36% | 8.02% | 8.02% |

| Confident | 4.87% | 6.66% | -10.33% | 7.76% | 6.09% | 9.93% | 9.93% |

| Ambitious | 5.11% | 9.66% | -9.39% | 9.46% | 9.10% | 11.58% | 11.58% |

| Adventurous | 5.06% | 12.75% | -9.14% | 11.35% | 12.27% | 12.95% | 12.95% |

How have Wealthify Investment Plans performed?

The graph below shows how each of our investment styles - from Cautious to Adventurous - have performed between 28th February 2018 and 31st December 2025, after all fees have been taken (based on 0.60% p.a. Wealthify management fee). These figures are based on the performance of Plans worth more than £100, figures will be different for Plans below that amount.

Original

Ethical

Of course, we experienced the ups and downs of the market along the way and you could get back less than you put in. Although we cannot rely on past performance to predict future results investing for the long-term (5 years or more) typically delivers positive returns. These figures are after all fees have been taken (based on 0.60% p.a Wealthify management charge), and are based on the performance of Plans worth more than £100 and will be different for Plans below that amount.

Ethical Plan performance by year

This table shows by how much each of our investment styles have grown each year

| Investment Style | 31/12/2019 - 31/12/2020 | 31/12/2020 - 31/12/2021 | 31/12/2021 - 31/12/2022 | 30/12/2022 - 30/12/2023 | 29/12/2023 - 29/12/2024 | 30/12/2024 - 30/12/2025 | |

|---|---|---|---|---|---|---|---|

| Cautious | 4.14% | 0.73% | -14.93% | 4.80% | 0.70% | 5.22% | 5.22% |

| Tentative | 6.45% | 4.11% | -15.65% | 6.85% | 2.77% | 5.75% | 5.75% |

| Confident | 9.04% | 7.63% | -16.51% | 8.81% | 5.01% | 6.12% | 6.12% |

| Ambitious | 11.16% | 11.18% | -17.42% | 11.08% | 7.34% | 5.64% | 5.64% |

| Adventurous | 13.43% | 14.65% | -18.72% | 13.63% | 9.98% | 5.63% | 5.63% |

Can I combine my pensions?

You may have several pensions with different providers, which can happen when you change jobs and leave an old workplace behind. Combining these old pensions together with one provider is known as pension consolidation and can make it easier to keep track of your pension pot.

Thankfully, combining your pensions with Wealthify is easy! Just let us know which pensions you want to combine, and we'll bring them all together into your Wealthify Pension.

With investing, your capital is at risk. The tax treatment of your investment will depend on your individual circumstances and may change in the future.

New to Wealthify Pensions?

If you're just setting out on your journey to get better control over your pensions, you don’t have to commit all of your hard-earned pensions at once. If you’d prefer, you can elect to transfer just part of your pension and transfer the rest at a later date if that feels right for you.

Simply start your transfer and select how much of your existing pension(s) you’d like to transfer using our Plan Builder.

Pension Transfer FAQS

Transferring your old pensions is easier than you might think – all we need to know is who your old providers are, reference numbers , an estimated value, and your permission to get in touch with your old providers regarding your pensions. You can usually find this information on your latest pension statement. We’ll do the rest and consolidate them into your Wealthify Pension.

If you’re an existing customer, simply head to your Dashboard and use the ‘transfer in’ button on your home screen.

You can transfer most types of pensions to Wealthify, apart from:

- Pensions with a defined benefit (DB), guaranteed annuity rate (GAR), guaranteed minimum pension (GMP), or final salary promise;

- Pensions with protected benefits such as Protected Tax-Free Cash, or Protected Pension Age;

- Pensions you’re already taking an income from;

- Overseas pensions, including Qualifying Recognised Overseas Pension Schemes (QROPS);

- Crystallised plans.

Please note we can only accept defined contribution plans that have no safeguarded benefits or guarantees.

No, unfortunately, we’re not able to accept pensions that are already in payment or if you’ve already taken income from.