Self-Invested Personal Pension (SIPP)

YOUR RETIREMENT. A WEALTHIFY PERSONAL PENSION.

- Set up your contributions today, via Direct Debit or as one-off payments.

- Receive automatic tax relief with a 25% top-up on personal contributions.

- Combine your old pensions into one by transferring to us with ease.

With investing, your capital is at risk. The tax treatment of your investment will depend on your individual circumstances and may change in the future. Minimum initial deposit of £500 required.

What is a SIPP?

A Self-Invested Personal Pension (or SIPP, for short) is a tax-efficient personal pension that gives you flexibility and control over your retirement pot.

You pay your own money into a SIPP, which will typically be invested in a wide range of investments, including shares, bonds, and property.

A SIPP provides two main tax benefits: you don’t pay capital gains or income tax on your investments as they grow, and you can get an instant government tax relief top-up of 25% on personal contributions.

So, let’s say you pay in £80; the government will then add another £20, turning that initial £80 into £100!

Another benefit is that you can adjust how much you pay in, making it a popular option for self-employed people looking to make personal contributions — and those looking to have more than just their workplace pension for retirement.

How does a Wealthify SIPP work?

Three simple steps. That’s all it takes to open a new Self-Invested Personal Pension with Wealthify!

You choose

From Cautious to Adventurous, Original or Ethical; start by telling us what type of investor you want to be.

We invest

Once we’ve established your investment style, our experts will build your Personal Pension Plan with just the right mix of investments.

We optimise

You then leave all the heavy lifting to us, as we monitor your Pension Plan and adjust it to keep your retirement on track.

OUR AWARDS CABINET

We're really proud of all the awards we've won since launching in 2016; not because we enjoy the recognition, but because it means we're doing something right (and that our customers are happy). These awards also help spread the word about Wealthify — meaning other people can start enjoying it, too!

Why choose Wealthify for your SIPP?

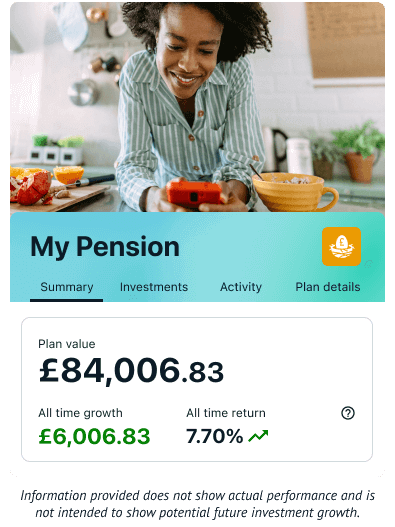

Backed and owned by Aviva, Wealthify was launched in 2016. Today, we’re trusted by over 100,000 people to look after their savings and investments.

But what makes us different — and why choose Wealthify for your Self-Invested Personal Pension?

Simple: You don’t need any previous investing experience with a Wealthify SIPP. Simply choose your initial investment amount and style (from Cautious to Adventurous; Original or Ethical), then you’re good to go!

Managed: We know pensions can be confusing, which is why our Investment Team manage it for you. This includes your 25% tax relief top-up on personal contributions, which we’ll automatically add to your pot and invest for you.

Transparent: With a Wealthify SIPP, we offer a simple annual management fee depending on the value of your investments; 0.6% for pension balances up to £100,000, dropping to just 0.3% for any portion of £100,000 or more. Payable monthly.

Flexible: Whether via Direct Debit or one-off payments, you can pay into a Wealthify SIPP as and when it suits you, helping you build a pension pot on your terms.

Support: When dealing with something as important as your pension, sometimes you just need to be able to speak to an actual human being about it. Thankfully, we’ve got an award-winning team of them, ready and waiting to answer your call, email, or secure message (please note, they're unable to give any financial or product advice).

Transferring a pension to Wealthify

Looking to transfer an old pension to a Wealthify SIPP?

Perhaps you have a handful of old workplace ones you’ve been wondering what to do with? If this sounds like you, then the good news is that transferring them is an equally simple three-step process, as we do all the hard work for you. And, with all your old pensions consolidated, your investments could build as one larger, combined amount!

Find your old pensions

Start by telling us a few details about your old pensions via an online transfer form, including a reference number and recent value.

The transfer process

We'll then talk to your provider(s) and start the transfer process, which usually takes within 30 days to complete.

Investing & optimisation

Based on your chosen investment style and Plan type, we'll build your Pension Plan and start investing, as well as optimise it when needed.

Secure

Your log-in details will be kept secure and never shared with anybody else.

Supported

Strength

Wealthify is owned and backed by Aviva: one of the UK's largest financial institutions.

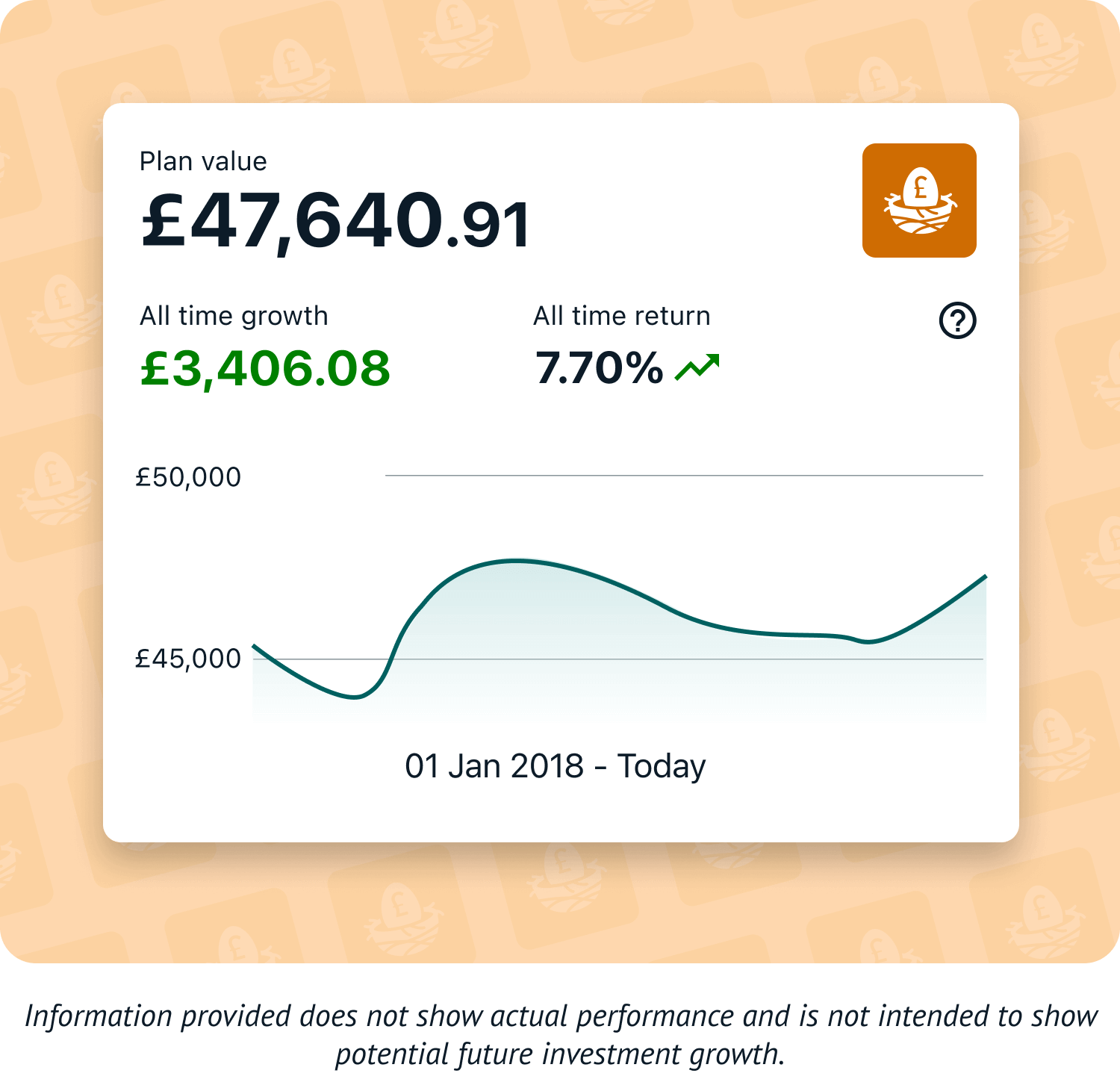

Pension calculator

For many people, the most daunting part of saving towards retirement is actually figuring out just how much you might need in the first place!

Easy and free-to-use for everyone - including non-Wealthify customers - our SIPP calculator is here to help you just do that.

Whether you're 25 or 65; Cautious or Adventurous with your investing style; making regular contributions or one-off payments; use it to explore and tweak various factors, helping you decide how to hit your target income for retirement.

SIPP fees

When saving over a long period of time – as is often the case with pensions – percentages make a difference. Sure, an extra 0.01% per year might not seem like much now. But over a lifetime, that small number could add up to a big one, essentially eating into your retirement savings.

That’s why SIPP fees matter — and why we’re completely transparent with ours: SIPP balances up to £100,000 have one annual management fee of 0.6%, and any portion thereafter is charged at a lower 0.3% fee. And, unlike some traditional providers, we won’t charge you for depositing or withdrawing money, transferring funds, or closing your Plan.

This annual management fee is payable monthly based on the value of your investments and covers everything we do, including setting up your account, looking after your money, and optimising your investments.

Please note that we've made sure that the management fee you pay Wealthify covers the cost of the Pension service provided by Embark Investment Services. Embark does, however, retain part of the interest earnt on cash to cover the cost of managing that cash.

As with most investments, average investment costs can apply but we aim to keep these as low as possible: around 0.16% per year for Original Plans and 0.7% per year for Ethical.

With investing, your capital is at risk. The tax treatment of your investment will depend on your individual circumstances and may change in the future.

Pension tips and insights

Not all personal pensions are the same, so we’ve created this useful guide to give you information on how a pension works, the different types of pension, how to set up a pension, reasons for consolidating pensions and much more.

This guide doesn't offer personal advice, speak to a financial adviser if you're unsure about whether investing is right for you.

Our reviews

SIPP FAQs

Currently, there’s no limit on how much you can pay into your pension, however, you won’t receive tax relief on anything over £60,000 or 100% of your salary, whichever is lower. The £60,000 limit includes all payments, including the government top up and employer contributions – so it is actually £48,000 of your contributions, plus £12,000 tax relief.

If you go over this limit you won’t receive tax relief and will have to pay an annual allowance charge which will be added to the rest of your yearly taxable income.

If your income is less than £3,600 a year, you will only be able to contribute up to £2,880 with tax relief. You can make further contributions but will not be not entitled to tax relief on them.

The following initial minimum deposits apply to each of our investment products.

Junior ISA: £1

Stocks and Shares ISA: £500

Personal Pension: £500

General Investment Account: £1,000

After opening your account, you can top-up (via one-off or regular monthly payments) a Junior ISA, Stocks and Shares ISA, and General Investment Account with £1 or more; Personal Pension payments need to be at least £50.

You can access your pension when you turn 55 (rising to 57 in 2028). Subject to current pension rules, you'll be able to withdraw 25% of the total amount tax-free, with the rest being taxed based on your individual circumstances. However, you don’t have to take any of your pension if you don’t want to. If you’re still working, for example, you can leave the money in your pension – and continue to contribute – until you retire.

The way you take your money out of your pension (a process known as moving your pension into drawdown), will vary depending on the type of pension you have.

If you have a defined benefit pension, you will receive a specific income for life, which should increase every year. If you have a defined contribution scheme, then you’ll be able to choose how you want to withdraw your funds using one of the following methods:

- Take your whole pension in one go as a lump sum.

- Withdraw money whenever you need it.

- Receive a regular income.

One of the easiest ways to trace old pensions is to use the government’s online Pension Tracing Service.

To use this service, you’ll need either the name of an employer or pension provider, as it can’t tell you whether you actually have a pension, or its value.

Once you’ve agreed to the service’s declaration, it’s then just a matter of answering a few simple 'yes’ or ‘no’ questions, including:

- Are you looking for an NHS, civil service, teacher or armed services pension?

- What type of pension are you looking for?

- Do you know the name of the employer, who set up your workplace pension?

- Do you know the name of your workplace pension scheme?

Wealthify automatically adds the 25% top up when you make a personal contribution to your pension and only if you ticked the box to state your eligibility for tax relief when you opened the SIPP. So, if you personally pay in £800, the government adds another £200, making the total £1000. However, if you’re a higher-rate taxpayer, you may be entitled to more, in which case you will need to contact HMRC to be able to access higher-rate tax relief. This will need to be submitted on your annual tax return.

When you open a SIPP with Wealthify, you must tick the box to say you are eligible for the tax top-up. We then automatically add the 25% top up to your pension when you make personal contributions. This means we do all the work for you and you don’t need to claim anything yourself. However, if you’re a higher-rate taxpayer, you’ll need to contact HMRC for tax relief at the higher rate.

You can transfer most types of pensions to Wealthify, apart from:

- Pensions with a defined benefit (DB), guaranteed annuity rate (GAR), guaranteed minimum pension (GMP), or final salary promise;

- Pensions with protected benefits such as Protected Tax-Free Cash, or Protected Pension Age;

- Pensions you’re already taking an income from;

- Overseas pensions, including Qualifying Recognised Overseas Pension Schemes (QROPS);

- Crystallised plans.

Please note we can only accept defined contribution plans that have no safeguarded benefits or guarantees.

No, unfortunately, we’re not able to accept pensions that are already in payment or if you’ve already taken income from.