Low investment fees

We keep costs low and transparent so that you can maximise your returns.

- We charge a simple annual fee of 0.6% for managing your investments (and an even lower rate of 0.3% on the portion of a Wealthify Personal Pension over £100,000).

- Wealthify Investment Plans have fund and trading fees of approximately 0.16% for Original Plans and 0.70% for Ethical Plans. Fund and trading fees vary, but we negotiate better fees than typically available, working hard to keep trading fees as low as possible.

- We won't charge you for any deposits, withdrawals, transfers, or if you close your Plan.

With investing, your capital is at risk. Tax treatments depend on your individual circumstances and may change in the future.

Calculate your fees

If you invest

You'll pay a monthly fee of around

(That's a year)

| Fees (p.a.) | 1st year | |

| Wealthify fee | ||

| Average investment cost | ||

| Total |

Reduced pension fee rate

Minimum deposits apply. With investing, your capital is at risk. Tax treatments depend on your individual circumstances and may change in the future.

These figures are intended as a guide. Fees are charged as a percentage of the total value of your Plans, and so the amount you pay will vary depending on the value of your investments across the month. Fees are quoted annually but charged monthly.

What do I get for my fee?

✓ Our team of investment experts build your Plan, making sure it’s aligned with your chosen investment style

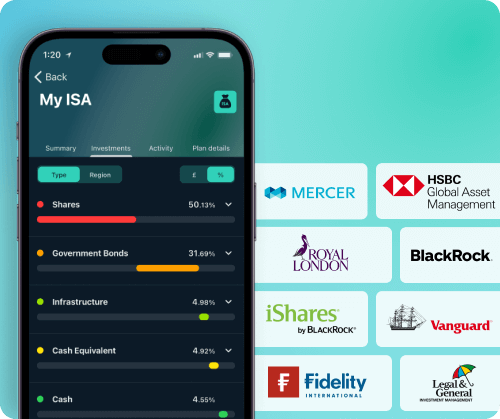

✓ Access to best in class funds – giving our customers exposure to entire markets

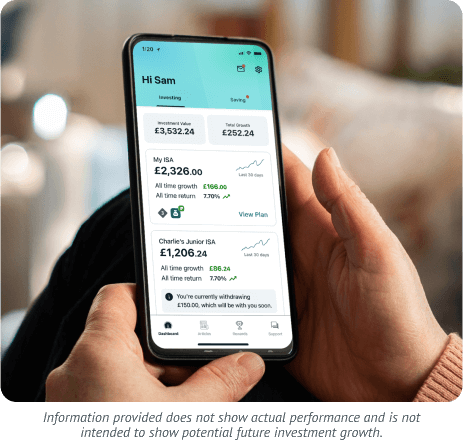

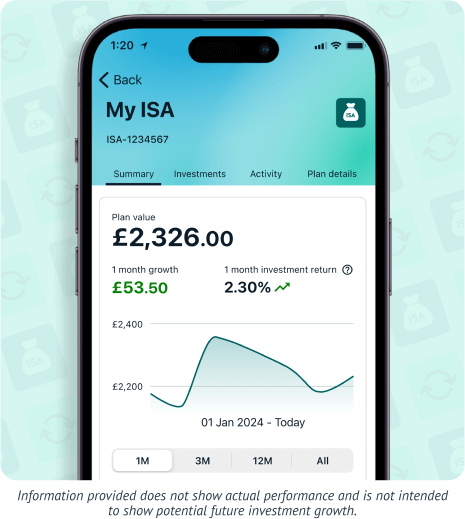

✓ Track your money 24/7 in-app or online

✓ Live Chat, telephone and email support from our award-winning team

✓ Ongoing monitoring and adjustments to your Plan to keep it on track

✓ Saving time and the potential trading fees of manually picking individual investments

✓ Your money and assets held securely

✓ Investment news and insights in our monthly market update and blog

Investment costs explained

Investment costs include fund charges, taken directly by the fund provider and market spread (the difference between the price we buy and sell investments).

Funds are a cost-effective and convenient way to buy lots of investments all at once. We invest your money in carefully selected low-cost funds, managed by reputable fund providers.

Wealthify Investment Plans each contain around 15 funds, which hold more than 8,000 diverse investments in total; such as stocks, bonds and property. Learn more here.

With investing, your capital is at risk. Tax treatments depend on your individual circumstances and may change in the future.

Our investing experts

At Wealthify, our team of highly experienced, qualified Investment Managers are always looking for opportunities to best position your investments, with the goal of protecting your money and achieving your long-term objectives.

Our reviews

Ready to invest?

We've built a range of award-winning products to help you achieve your financial goals.