FLEXIBLE STOCKS AND SHARES ISA

Award-winning and effortless

- A Stocks and Shares ISA could provide better long-term returns than a Cash ISA.

- Choose what kind of investor you want to be, then our experts will build and manage your Plan for you!

- Fees are low and transparent, meaning you get to keep more of your money.

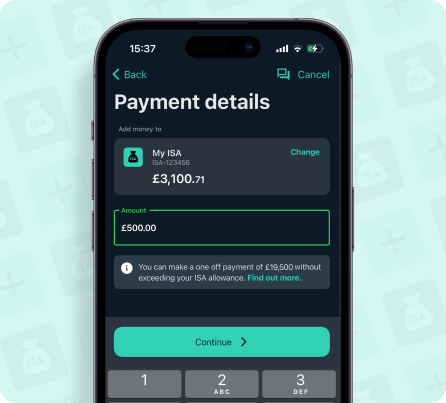

- Withdraw money and return it — without using up your annual allowance.

Get started with a minimum £500 initial deposit, then make further ad hoc or monthly deposits, big or small, to suit you.

With investing, your capital is at risk. Tax on investments depends on your individual circumstances and can change. ISA rules apply.

OUR AWARDS

We're really proud of the 60+ awards we've won since launching in 2016; not because we enjoy the recognition, but because it means we're doing something right and that our customers are happy.

What is an ISA?

Launched in 1999, ISA stands for Individual Savings Account. ISAs are a tax-efficient way to save or invest up to £20,000 each tax year; this £20,000 is known as your annual ISA allowance. At Wealthify, we offer a flexible Stocks and Shares ISA, meaning you’re able to withdraw money from your account and deposit it back in within the same year — without affecting your annual allowance.

These are four different types of ISAs: Stocks and Shares ISA (aka Investment ISA); Cash ISA; Innovative ISA, and Lifetime ISA (which has a £4,000 allowance). Even though all four ISAs offer different options and benefits, you can split your annual £20,000 allowance between them.

The great thing about ISAs is that you don’t have to pay capital gains tax or income tax on any of the money you earn. This means you get to keep more of the interest or returns you make!

Getting started

As with everything we do at Wealthify, we’ve made the process of opening a Stocks and Shares ISA as simple as possible.

You choose

From Cautious to Adventurous, choose your investment style and let us know how much you'd like to get started with.

You answer

Answer a few questions in our suitability quiz, which helps you start an ISA that's right for your circumstances and attitude towards investing.

We build

Our team of investment experts then get to work building your Plan, making sure it’s aligned with your chosen investment style.

We manage

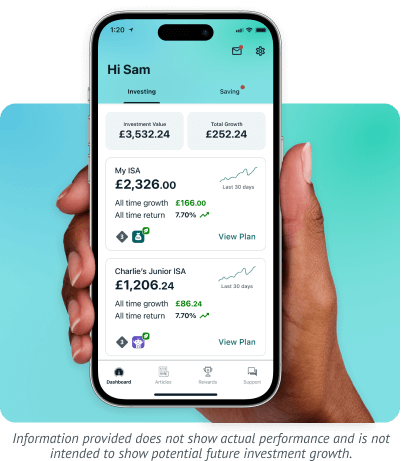

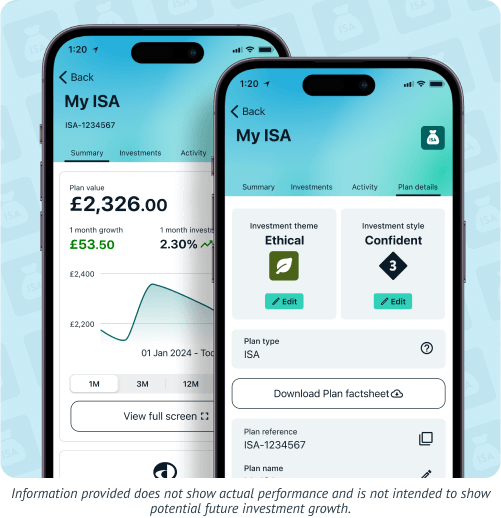

Just sit back, relax, let us manage everything for you — and use our online dashboard or app to follow your Plan's performance!

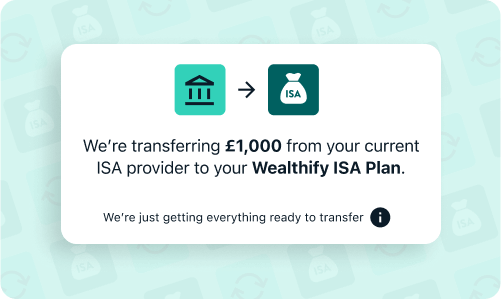

Transferring an ISA?

Here are a few things to consider

- You can transfer any Cash ISAs or Stocks and Shares ISAs (Investment ISAs) you have with other providers in to a Wealthify Investment ISA.

- When you transfer an ISA to Wealthify, you should always use the official ISA transfer form to retain the ISA tax benefits.

- Transferring ISAs from previous tax years doesn’t impact your current ISA allowance, so you can still put up to £20,000 into an ISA this tax year.

Why choose Wealthify?

Whether you're looking for your financial piece of the pie or peace of mind: investing with Wealthify is the confidence that comes with taking control of your tomorrow — today.

Using our simple, award-winning app or website, set up a Wealthify Flexible Stocks and Shares ISA on your terms. Whether you’re cautious, ambitious, or ethical with your money, we manage everything, helping you get more from your investments by doing less.

And that's why, if you value your time just as much as your finances, the smart money’s with Wealthify.

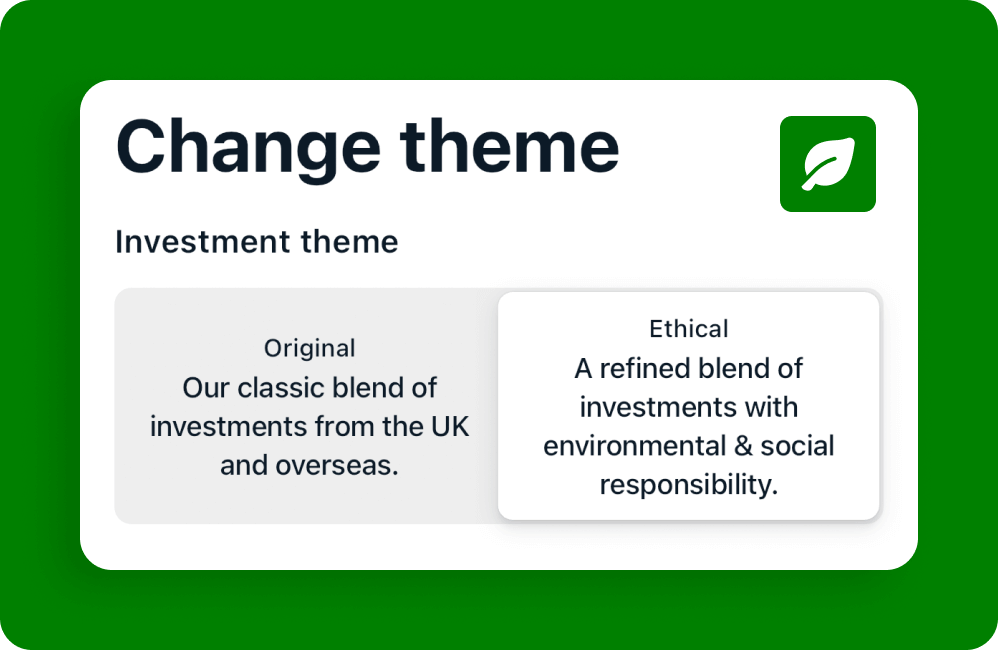

Ethical investment options

With Wealthify, investing for your future also means being able to invest in the planet's future at the same time.

That's why we've joined forces with best-in-class ethical fund providers, to create five Ethical Plans that let you invest in organisations committed to having a positive impact on society and the environment. All our fund providers are signatories of the Principles of Responsible Investing (PRI), the world’s leading proponent of responsible investing.

The actively managed ethical funds employed in plans keep a close eye on the organisations in which they invest - employing rigorous, ongoing screening to ensure ethical standards are maintained.

How have Wealthify Investment Plans performed?

The graph below shows how each of our investment styles - from Cautious to Adventurous - have performed between 29th February 2016 and 30th November 2025, after all fees have been taken (based on 0.60% p.a. Wealthify management fee). These figures are based on the performance of Plans worth more than £100, figures will be different for Plans below that amount.

Original

Ethical

Of course, we experienced the ups and downs of the market along the way and you could get back less than you put in. Although we cannot rely on past performance to predict future results investing for the long-term (5 years or more) typically delivers positive returns. These figures are after all fees have been taken (based on 0.60% p.a Wealthify management charge), and are based on the performance of Plans worth more than £100 and will be different for Plans below that amount.

Original Plan performance by year

This table shows by how much each of our investment styles have grown each year

| Investment Style | 31/12/2019 - 31/12/2020 | 31/12/2020 - 31/12/2021 | 31/12/2021 - 31/12/2022 | 30/12/2022 - 30/12/2023 | 29/12/2023 - 29/12/2024 | 29/11/2024 - 29/11/2025 |

|---|---|---|---|---|---|---|

| Cautious | 2.70% | 0.50% | -11.20% | 4.70% | 1.00% | 5.00% |

| Tentative | 3.90% | 3.70% | -10.80% | 6.20% | 3.40% | 6.80% |

| Confident | 4.90% | 6.70% | -10.30% | 7.80% | 6.10% | 8.60% |

| Ambitious | 5.10% | 9.70% | -9.40% | 9.50% | 9.10% | 10.30% |

| Adventurous | 5.10% | 12.70% | -9.10% | 11.30% | 12.30% | 11.70% |

How have Wealthify Investment Plans performed?

The graph below shows how each of our investment styles - from Cautious to Adventurous - have performed between 28th February 2018 and 30th November 2025, after all fees have been taken (based on 0.60% p.a. Wealthify management fee). These figures are based on the performance of Plans worth more than £100, figures will be different for Plans below that amount.

Original

Ethical

Of course, we experienced the ups and downs of the market along the way and you could get back less than you put in. Although we cannot rely on past performance to predict future results investing for the long-term (5 years or more) typically delivers positive returns. These figures are after all fees have been taken (based on 0.60% p.a Wealthify management charge), and are based on the performance of Plans worth more than £100 and will be different for Plans below that amount.

Ethical Plan performance by year

This table shows by how much each of our investment styles have grown each year

| Investment Style | 31/12/2019 - 31/12/2020 | 31/12/2020 - 31/12/2021 | 31/12/2021 - 31/12/2022 | 30/12/2022 - 30/12/2023 | 29/12/2023 - 29/12/2024 | 29/11/2024 - 29/11/2025 |

|---|---|---|---|---|---|---|

| Cautious | 4.10% | 0.70% | -14.90% | 4.80% | 0.70% | 4.00% |

| Tentative | 6.50% | 4.10% | -15.70% | 6.90% | 2.80% | 4.50% |

| Confident | 9.00% | 7.60% | -16.50% | 8.80% | 5.00% | 4.90% |

| Ambitious | 11.20% | 11.20% | -17.40% | 11.10% | 7.30% | 4.40% |

| Adventurous | 13.40% | 14.70% | -18.70% | 13.60% | 10.00% | 4.50% |

Keeping your money safe

We know the only thing more important than making your money work harder, is making sure it’s safe — here’s how we take care of yours.

Secure

Your login details will always be kept secure – but never shared with anyone else.

Support

Our friendly Customer Care Team are always happy to help via email, Live Chat, or on 0800 802 1800.

Strength

Wealthify is owned and backed by Aviva: one of the UK's largest financial institutions.

Wealthify Customer Reviews

Related blogs

Investment FAQs

You can open an ISA with Wealthify if you:

Are over 18

Are UK tax resident

When you’re building your Personal Investment Plan, the first question you will be asked is whether you would like to open an ISA or a General Investment Account. Select ‘ISA’ to create an Investment ISA Plan. Under the current rules, you can have as many ISAs of each type you want (excluding Lifetime ISAs and Junior ISAs), and you can split your annual ISA allowance between them however you like.

If you’re likely to exceed your ISA allowance, you can simply set up a General Investment Plan to invest additional funds. There’s no extra cost for having two or more Plans.

The following initial minimum deposits apply to each of our investment products.

Junior ISA: £1

Stocks and Shares ISA: £500

Personal Pension: £500

General Investment Account: £1,000

After opening your account, you can top-up (via one-off or regular monthly payments) a Junior ISA, Stocks and Shares ISA, and General Investment Account with £1 or more; Personal Pension payments need to be at least £50.

The ISA limit and maximum you can save each year is £20,000. The tax year runs from the 6th of April to 5th of April the following year. Under the current rules, you can have as many ISAs of each type you want (excluding Lifetime ISAs and Junior ISAs), and you can split your annual ISA allowance between them however you like.

Nothing at all. A Stocks and Shares ISA and an Investment ISA are just different names for tax-free investments.

Yes, you can withdraw funds from your ISA plan at any time, without penalty. Since both our Stocks and Shares ISA and Cash ISA are flexible, you can also withdraw and replace funds within the same tax year without affecting your annual ISA allowance.

Need more help?

If you’ve got any more questions, then our award-winning Customer Care Team are ready to answer them. Just click on the button below to get in contact.