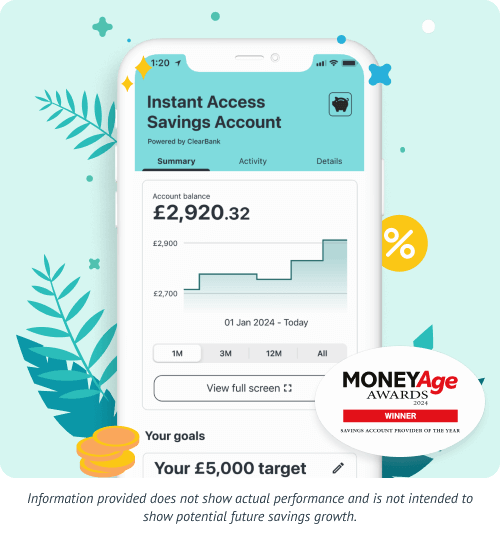

INSTANT ACCESS SAVINGS ACCOUNT

Powered by ClearBank

Our Instant Access Savings Account gives you the flexibility to save on your terms.

- Earn 3.61% AER / 3.55% gross p.a. (variable) paid monthly.

- Deposit as much as you like, with no upper limit.

- Access your money instantly, whenever you want.

The tax treatment of your savings will depend on your individual circumstances and may change in the future.

How does a Wealthify savings account work?

To be eligible for this Savings Account, you'll need to be a UK resident (excluding the Channel Islands), UK taxpayer, and aged 18 or over.

Set up

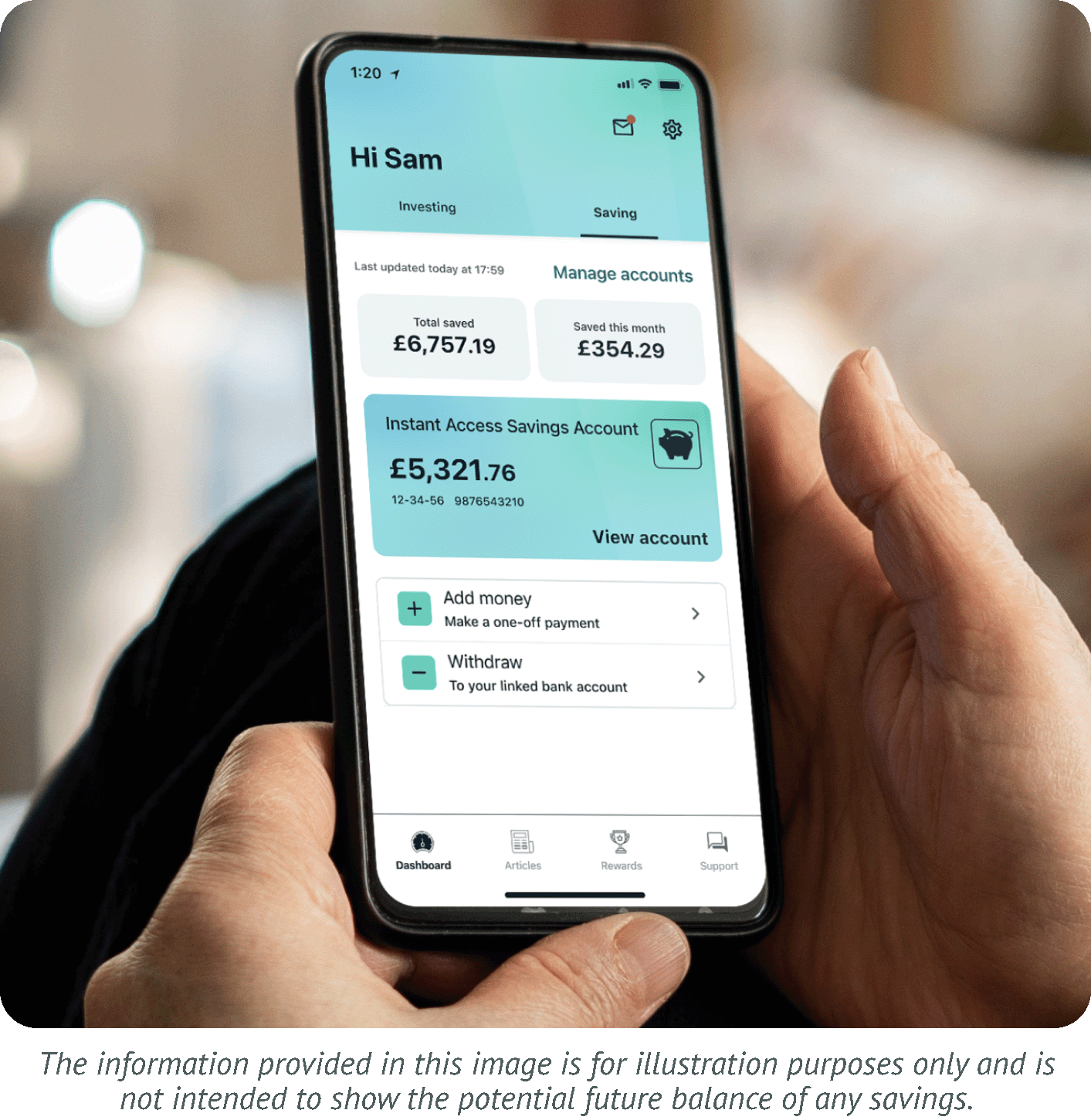

Use our website or app to plan how much you want to save, before telling us your basic details.

Grow

Once your account is open, your savings will start to earn interest, which is paid-in to your account monthly.

Access

Watch your savings grow, knowing you can access your money at any time — without having to pay any fees.

Awards

We're really proud of all the awards we've won since launching in 2016; not because we enjoy the recognition, but because it means we're doing something right (and that our customers are happy). These awards also help spread the word about Wealthify — meaning other people can start enjoying it, too!

Advantages of a Wealthify Savings Account

From rainy days to special days, unexpected bills to poolside chills; saving with Wealthify is about so much more than just 'putting money away'.

It's about the satisfaction of knowing you're on top of your savings - and peace of mind that comes with being financially prepared.

- Instant Access: There are no notice periods, long waits, or penalties for withdrawing early. You can withdraw your funds at any time via the app or online account.

- 3.61% AER / 3.55% gross p.a. (variable): our variable interest rate automatically tracks the Bank of England base rate, minus a margin (currently 0.45%), meaning you don't have to worry about what to do at the end of a fixed term.

Secure

Your login details will always be kept secure — but never shared with anyone else.

Support

Our friendly Customer Care Team are always happy to help via email, Live Chat, or on 0800 802 1800.

Strength

Wealthify is owned and backed by Aviva: one of the UK's largest financial institutions.

Powered by ClearBank

Wealthify, in collaboration with ClearBank, are providing you with an Instant Access Savings Account. Wealthify will provide the day-to-day servicing of the account (including being the point of contact for any questions you may have), with ClearBank providing the account itself.

All your eligible deposits in accounts powered by ClearBank are added together when determining your level of Financial Services Compensation Scheme (FSCS) protection. Compensation is limited to a maximum of £85,000 per person per banking licence. See which other deposit providers have accounts powered by ClearBank using ClearBank's banking licence here: FSCS Protection.

Our reviews

Savings Account Tips and Insights

What is the base rate, and what does it mean for you?

"Picture your savings as your financial safety net: your go-to for short-term emergencies and immediate peace of mind.

"In the meantime, the Bank of England's base rate (the interest rate it sets out for banks and financial institutions to control inflation) remains high. Typically, a high interest rate is bad for borrowing but great for savers — although many high street banks have failed to pass much of these higher rates to consumers.

"The Wealthify Instant Access Savings Account gives you the comfort of knowing your savings are working hard for you. Combining a variable interest rate, the flexibility to save at a level that suits you, and freedom to withdraw funds whenever you need them; Wealthify is now a great place to manage both your cash savings and investments."

Savings Account FAQs

There is no limit on how much to you can pay in to a Wealthify Instant Access Savings Account. However, consider that the UK Financial Services Compensation Scheme (FSCS) gives protection up to £85,000 across all your ClearBank products.

Clearbank Limited power our Instant Access Savings Account. All money held within our Instant Access Savings Accounts is sent directly to ClearBank, and is never held by Wealthify.

ClearBank are authorised by the Prudential Regulation Authority. They are regulated by both the Financial Conduct Authority and the Prudential Regulation Authority.

Financial Services Register number: 754568

Registered address: ClearBank, Borough Yards, 13 Dirty Lane, London, SE1 9PA.

For more information, click this link.

Please note: correspondence regarding your Savings Account should be sent directly to Wealthify via our Live Chat service, email, or by calling us at 0800 802 1800.

No fee will be charged for the management of your savings account at Wealthify.

The current minimum deposit in a Wealthify Instant Access Savings Account is just £1.

The current maximum is unlimited.

Customers can only pay in and out of their savings account from their nominated bank account.

This includes manual bank transfers or one-off payments. You're also able to set up standing orders from your nominated bank account to make regular payments into your Wealthify Instant Access Savings Account.

You can find out more about the Bank of England base rate by following this link.

AER (Annual Equivalent Rate) calculates how much interest you earn over a year, taking compounding (the interest you earn on interest) into account. AER is displayed on all UK savings accounts, and is a good way to compare rates.

Gross interest doesn't include compounding, and refers to the amount of interest paid to you without the deduction of UK income tax.

A VRP is a variable recurring payment. They are similar to Standing Orders, where you set up a recurring payment, selecting an amount and date that the payment will automatically be taken on.

VRPs can be taken any day of the week including weekends and bank holidays. Please note other methods such as Standing Orders are limited to weekdays.

We currently offer VRPs to be used for our Instant Access Savings Accounts (IASA) only. Other plan types may still require Direct Debits or Standing Orders instead.

You can indeed have both a VRP and Standing Order set up. However, if you have VRPs available then you will not see the screen to set up a Standing Order. Therefore, if you want to make use of both you will need to set up the Standing Order directly with your bank.

When doing so, you will need to use your savings account details that can be found on the ‘Plan Details’ section of your plan page.

Only certain banks are eligible to set up a VRP against our savings accounts. To check if you are able to set one up, you can use the below instructions to help get started!

On the Website

- Open the website and sign in.

- Click "View Plan" on your Instant Access Savings Account.

- On the right of the page, you will see the option to set up a VRP.

- Click this and follow the instructions on the screen.

On the App

- Open the app and sign in.

- Tap "View Plan" on your Instant Access Savings Account.

- On the top right, tap "Plan Details" and then select the option to set up a VRP.

- Tap this and follow the instructions.

You can use the below instructions to edit your VRP:

On the Website

- Open the website and log in.

- Click "View Plan" on your Instant Access Savings Account.

- In the area for your VRP, click the "Edit" button.

- Input the new information and click "Update”.

On the App

- Open the app and log in.

- Click "View Plan" on your Instant Access Savings Account.

- Tap "Plan Details" and then tap the pencil that is in the area for your VRP.

- Input the new information and tap "Update".

Unfortunately, not all banks are eligible to set up a VRP for use with your savings account. However, the list of eligible banks is subject to change, so yours may be able to use this feature in the future.

For the meantime, you are still able to set up a regular standing order! To do so, you will need to use the account details found in the ‘Plan Details’ section of your savings account to set this up directly with your bank.

Blog Articles

The Wealthify guide to saving a lump sum

Our handy guide to help you make the most of a lump sum.

Income tax brackets and allowance

What are they — and how do they affect your Personal Tax Allowance?

Do I have to pay tax on my savings account?

Find out more about the potential tax implications of saving money.

Why do interest rates go up and down?

We all know it happens, but have you ever actually asked yourself why?