Pension Consolidation

Combining pensions into one easy-to-manage pot with Wealthify is simple, but to ensure you’re getting a pension that’s right for you, there are a few things to check:

✓ Fees: At Wealthify, there's a low annual management fee of 0.6% for balances below £100,000 — dropping to just 0.3% for any portion above that. Please understand how your current fees compare with ours.

✓ Charges: We don’t charge you for transferring to or from Wealthify. However, always check to see whether your existing pension provider has an exit charge.

✓ Benefits: Check you won't lose features such as loyalty bonuses.

ⓘ You can usually find this information on your existing statements, online account, or over the phone.

Other things to know:

- In your interest, we can't accept transfers of pensions with safeguarded benefits such as Defined Benefit pensions, those with a guaranteed income, or those where you can get more than your 25% tax free cash.

- We can’t accept transfers from pensions you’re already taking an income from.

- While the transfer takes place, your pension will be ‘out of the market’, as your existing provider needs to sell your investments before transferring it as cash.

- Combining two or more pensions doesn’t guarantee more money in retirement and investment performance is never guaranteed.

With investing, your capital is at risk. The tax treatment of your investment will depend on your individual circumstances and may change in the future.

OUR AWARDS CABINET

We're really proud of all the awards we've won since launching in 2016; not because we enjoy the recognition, but because it means we're doing something right (and that our customers are happy). These awards also help spread the word about Wealthify — meaning other people can start enjoying it, too!

What is pension consolidation?

In simple terms, pension consolidation means combining multiple pensions into one.

Considering most people have multiple jobs in their lifetime, chances are they’ll also have multiple pensions with different providers as a result.

By combining pensions – including old workplace ones – the idea is to make it easier to control your finances for retirement by having a single pot to manage (as opposed to multiple pots).

As well as making things easier to manage, pension consolidation also means only having to pay one provider fee — potentially saving you money in the long run if your existing providers have higher fees!

It’s important to understand that pension consolidation doesn’t have to mean transferring all your pension pots: if it makes more sense to transfer just a few, you can do that, too.

How to consolidate your pensions

The first step involves finding your lost pensions, which can be done using the government’s free Pension Tracing Service.

Once found, you’ll then need to check a few things before going ahead with pension consolidation, including:

Fees: At Wealthify, SIPP balances up to £100,000 have one annual management fee of 0.6%, and any portion thereafter is charged at a lower 0.3% fee. When considering consolidation, please understand how your current fees compare with ours.

Charges: We don’t charge you for transferring to or from Wealthify. However, some pension providers may charge an exit fee for transferring out, so make sure you ask your current providers about their transfer policies.

Benefits: It’s important to check that you won't lose features such as loyalty bonuses.

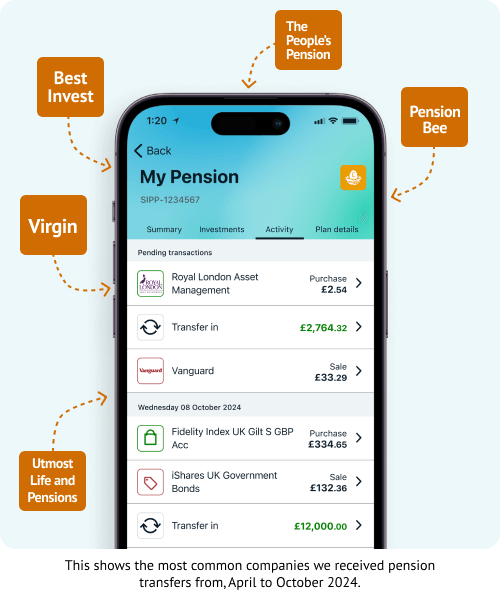

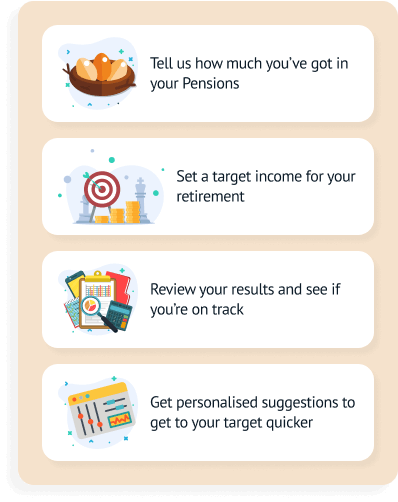

From there, combining pensions with Wealthify can be done in four simple steps. Please note that you can transfer one pension at a time — or add multiple ones if you want to combine more.

You create an account

Simply tell us a few details about yourself, including answering a few suitability questions to help us find the right investment style for you.

You tell us about your provider

This includes your existing pension provider’s name, account reference number, and approximate value.

We transfer everything for you

Authorise the pension transfer, then we’ll contact your existing provider, before transferring your pension's current cash value into your new Wealthify Pension.

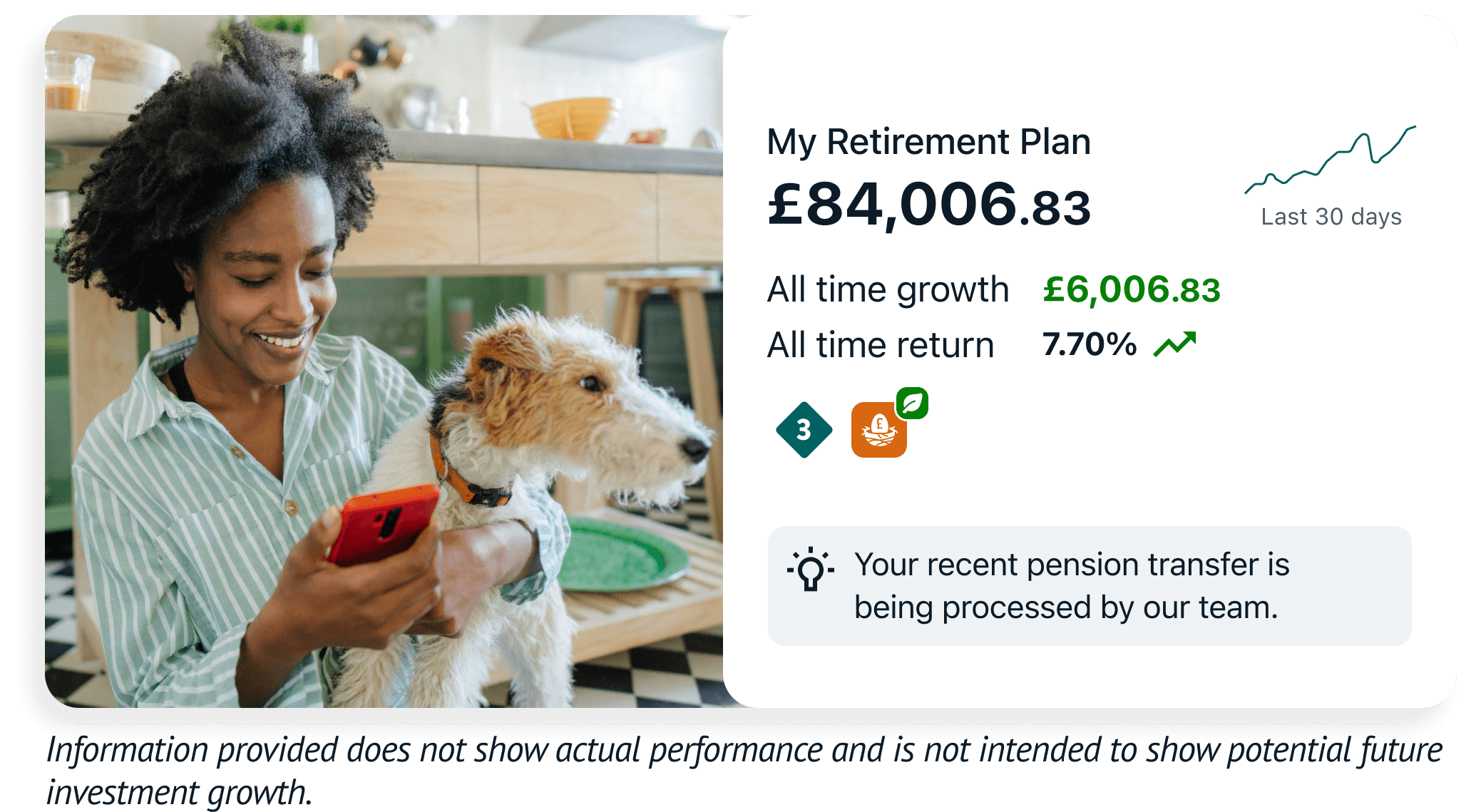

We build and manage your pension

Our team of investment experts build your Pension Plan, monitoring and optimising its performance to keep your retirement goals on track.

Why choose Wealthify for your pension consolidation?

Owned and backed by Aviva – one of the UK’s largest financial services institutions – Wealthify is a name you can trust. That aside, there are plenty of other reasons why you might choose us to look after your pension, including our:

- Simple pension transfer process: When it comes to pension consolidation, we don’t charge you for combining pensions, giving you the flexibility to invest on your terms.

- Instant 25% tax relief top-up: With a Wealthify Pension, we add the government's 25% tax relief top-up on all your personal contributions.

- Easy-to-use platform: Whether you’re using the Wealthify app or online dashboard, our award-winning platform makes managing your pension simple.

- Expertise: As well investment professionals looking after your pension, we’ve also got a team of customer service experts ready and waiting to help you when needed.

Pension pot calculator

Before combining pensions, you might want to use our pension calculator to get an idea of how much your pot could be worth in retirement. After all, a clearer picture of what you have now, could help create a clearer plan for what you’ll need in the future.

To get the most out of our calculator, all you have to do is let us know how much is in your pension(s), when you're planning to retire, and how much you regularly contribute.

The good thing about our calculator is that you can play around with certain figures to change the projections, which is handy in case your circumstances change in the future — or if you’re just feeling curious!

The calculator will then apply our projected investment performance, giving you an idea of how much your pension could be worth. Please remember, however, that the value of your investment could go down, and up and you could get back less than you put in.

With investing, your capital is at risk. The tax treatment of your investment will depend on your individual circumstances and may change in the future.

Secure

Your log-in details will be kept secure and never shared with anybody else.

Supported

Strength

Wealthify is owned and backed by Aviva: one of the UK's largest financial institutions.

How do I find all my pensions?

If you’re looking for a simple starting point when knowing how to merge pensions, look no further than the government’s free Pension Tracing Service.

This service checks over 200,000 workplace and personal schemes to try and track down old pensions — although it can only provide contact details for pension providers. It can’t tell you whether or not you actually have a pension with a particular provider or, if you do, what that pension’s value is.

Once you have found them, don’t forget that we can then take all the hard work out of combining them for you!

For even more information about pension consolidation in the meantime, why not check our guide to finding lost pensions?

Is there a fee for pension consolidation?

If you’ve made it this far and feel as though pension consolidation with Wealthify could well be for you, one last thing to consider is fees.

With Wealthify, however, we don’t charge you for combining pensions — and it’s as simple as that.

Read our pension consolidation guide

Consolidating pensions may seem complicated at first, so we’ve created this useful guide to give you information on:

- What pension consolidation is.

- The benefits of consolidating your pensions.

- Important things to consider before consolidating your pensions.

- How to track down lost pensions.

This guide doesn't offer personal advice, speak to a financial adviser if you're unsure about whether investing is right for you.

Our reviews

Pension consolidation FAQs

Wealthify’s Pension Finder is a free service that helps you track down old pensions you may have lost or forgotten about. Whether you’re trying to find previous workplace pensions or personal pensions, our expert partner, Raindrop, do all the hard work searching — so you don’t have to.

Pensions will be searched for based on the employer and/or provider details given. If found (and provided we can accept them), you’ll then have the option to transfer to a Wealthify Self-Invested Personal Pension.

Provided you've given us all the necessary information, the process can take anywhere from 2 to 12 weeks. Regardless of whether we find your pension(s) or not, we’ll confirm either way by contacting you as soon as possible using the contact details you provided.

We can’t search for:

- Public sector pensions (e.g. NHS, Councils);

- Pensions from employment ending before 1990, or ones you left before turning 22.

- Pensions from employment that lasted less than 3 months or less than 2 years before 2000.

- Your current work place pension that you are actively contributing towards.

One of the easiest ways to trace old pensions is to use the government’s online Pension Tracing Service.

To use this service, you’ll need either the name of an employer or pension provider, as it can’t tell you whether you actually have a pension, or its value.

Once you’ve agreed to the service’s declaration, it’s then just a matter of answering a few simple 'yes’ or ‘no’ questions, including:

- Are you looking for an NHS, civil service, teacher or armed services pension?

- What type of pension are you looking for?

- Do you know the name of the employer, who set up your workplace pension?

- Do you know the name of your workplace pension scheme?

Yes, the service is completely free — you’ll just need to provide basic information like your name, age, and address to be able to use it.

If you’re looking to claim the pension of someone who’s passed away, you’ll need to start by contacting the provider or, in the case of a workplace pension, the employer. If you can’t find the pension but believe the person might have had one, you can use the government’s Pension Tracing Service to help, too.

You can transfer most types of pensions to Wealthify, apart from:

- Pensions with a defined benefit (DB), guaranteed annuity rate (GAR), guaranteed minimum pension (GMP), or final salary promise;

- Pensions with protected benefits such as Protected Tax-Free Cash, or Protected Pension Age;

- Pensions you’re already taking an income from;

- Overseas pensions, including Qualifying Recognised Overseas Pension Schemes (QROPS);

- Crystallised plans.

Please note we can only accept defined contribution plans that have no safeguarded benefits or guarantees.

No, unfortunately, we’re not able to accept pensions that are already in payment or if you’ve already taken income from.