Raising a child can be a wonderful and life-enriching thing. But there's no shying away from the other side of the coin — it also comes with some significant costs along the way.

Parents across the UK are likely to be well aware that the period between parental leave and their child starting school, alone, may be enough to put the average person on the financial back foot [1] (and that’s just at the beginning of their little one’s life). So, thinking ahead for their own financial future, perhaps you want to give your child the opportunity to be as prepared for life as possible.

Offering them a financial education with a sprinkle of your own family’s values could be just the thing. And we’ve taken the hard work out of it for you and put together this simple guide to offer your child a suitable financial literacy lesson at the right age. Give this blog a bookmark and come back whenever you need to find out what financial lessons your child might need over the years ahead.

Jump to:

- Advantages of financial literacy

- Under 5’s: Differentiate between needs and wants

- Ages 5-7: Budgeting for kids

- Ages 7-9: Spend, save, or invest

- Ages 10-11: How to make money

- Ages 11-12: How insurance works

- Ages 12-13: How taxes work

- Ages 13-14: Borrowing and debt

- Ages 14-15: What is a pension pot

- Ages 16-17: How mortgages work vs renting

- Ages 17-18: Household bills

- Summary

Advantages of financial literacy

Empowering your child with the knowledge to use the financial products and tools they’ll need in life could offer them a significant leg up compared to their peers who don’t receive the same education. According to the OECD/INFE’s international study of financial literacy, it stated that those with a higher level of financial literacy are associated with greater financial wellbeing on an individual level. With emphasis placed on their resilience to handle negative financial shocks [2].

As a parent, you may chalk it up to one key thing — helping them build their confidence to manage life ahead.

Differentiate between needs and wants

Ages: 4-5

Once your little one was walking and talking, they were likely also asking for things too: toys, sweeties, balloons, ice cream, a one-minute ride on an electric rocking horse as you stand outside a shop looking at your watch — you know the drill.

But turning this into a life lesson early enough could help set them up for positive decision-making in the future.

That’s not to say you need to teach them to restrict all treats and fun! But helping them to differentiate between the occasional nice-to-haves versus the essentials on the shopping list is a solid step towards building good financial habits.

One idea could be to do a shopping basket and cash register roleplay at home (before venturing to the shops to do it in real life); playing shopkeeper and customer at a greengrocer’s or pretend supermarket.

- Play by showing them what’s on the shopping list and how there’s only enough money for certain items today.

- The next time you play, you could explain there’s a little left over for a small treat and let them pick something they want.

- Ask them often, “Hmm, is that something that we need (on the shopping list), or is that something that you want?” to give them a sense of responsibility.

- Then roll it out in real life by trialling it at the supermarket. You could empower them by leaving them in charge of holding the shopping list and working through it together to pick up the items you need.

Budgeting for kids

Ages: 5–7

Although each family is different, your child might start to receive pocket money, earn an allowance by doing chores, or get monetary gifts for birthdays or special occasions by this age. And once they have it, you probably want to empower them to know how to budget for things with it.

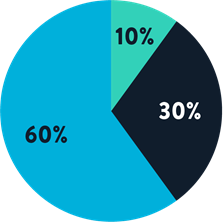

As the grown-up, you could adapt a standard budgeting technique, like the 60/30/10 rule to suit a child’s spending needs. This would typically be 60% of their money goes towards essential outgoings, 30% towards wants/lifestyle, and 10% for saving/investing, otherwise.

Being a child, it’s likely that they don’t need to pay for things at this age (cue a quick explainer that as you grow up, there will likely be more things they need to pay for), but for now, they can relax — as the money in their hands would likely fall into the wants category. And that means they can likely afford to save or invest more of their money for now.

A key message here is that budgets are flexible, and they can be tweaked to reflect how much spare cash is available.

But what if they want multiple things of different values? Here’s a way to help them understand how to categorise budgeting for these:

- Buying sweets or small toys is money they won't get back, so ask them how much of their cash they're willing to spend on these things. You could also explain that, as a grown-up, spending works the same way; whether it's buying gifts for people, paying for a haircut, or getting the car fixed, that money is gone once it's spent.

- Saving up for something like the latest games console might need more than what they currently have — things that you’d save up for because they are expensive but achievable (even if it takes many months or a couple of years). Ask them how much of their money they’d like to put aside for this goal at this time, building the idea that it’s something to work towards, but doesn’t need to be the total amount of their pocket money, allowance, or birthday money.

- The third option is to involve your child in deciding how much you set aside to invest for them each month through a Junior ISA. You could ask them what amount feels comfortable, helping them understand investing at their own pace while you explain any risks involved. Regularly showing them how their JISA is performing helps them see how long-term investing works. It may be worth establishing a habit of setting aside a set percentage each month from the outset — this teaches them the value of consistent investing and demonstrates how much time can work in their favour when they start young.

Spend, save, or invest

Ages: 7–9

Off the back of flexing their budgeting skills, this could be the ideal time to dive deeper into the concept of what to do with their money by covering off:

- Spending;

- Saving;

- And investing.

In particular, you could show how bank accounts or similar platforms work — and how they could make money by holding their money in certain accounts.

1. Explain most people put their ‘spending money’ in a current account

You could use mum/dad/whoever your family role models are as examples and explain they might use a current account to hold the money for food shopping, putting petrol in the car, or other needs.

Cover off that this isn’t an account where they’d typically receive interest or profits on their money. This might be their first introduction to the concept of compounding interest, though, so this is a good segue into earning interest and how compounding works.

If it helps them to visualise it, you can describe compounding interest as a snowball rolling down the hill, getting bigger as it picks up small amounts of snow from the ground. The same applies to money held in a savings or investing account.

2. Earning interest in savings accounts

People might use a savings account which offers interest for things they want to save up for, but that they can’t afford right away (explaining savings accounts are typically used for things they’d like to purchase within the next five years).

Use an example for whatever they have their eyes on as a savings goal...a games console, new bike, etc.

Calculate together how much money and time it will take to save up for this item. While you’re at it, explain how the AER% (annual equivalent rate) of their savings account would pay them that amount in interest over a year.

3. Introduce the concept of investing

The next way they’d hopefully benefit from compounding interest is through investing.

You could explain that investing is something you do for your future and that it’s a long-term thing (over five to ten years, and ideally more). Of course, this might seem like a very long time to a child’s mind, but you’ll be planting a seed to get them accustomed to thinking ahead when considering their money.

Explain that investing is when you decide to take some of your money for ‘wants’ and you invest it into a company. If the company does well, they pay some of their profits back as a ‘thank you’ for investing in them. These little payments are added to their original invested money and could help their money grow over a long period of time.

You could get them accustomed with what to expect from investing by playing with our Junior Stocks and Shares ISA ‘Create a Plan’ settings and sliders (explaining that these are projected values, not guarantees, that they could get back less than they put in, and that the money is locked in until they are 18 with this product):

Wealthify does not provide financial advice. Please seek financial advice if you are unsure about investing.

Imparting this information to them could help them understand:

- What type of common accounts there are,

- How to use one to reach their money goals,

- How their money could make money within certain types of accounts.

How to make money

Ages: 10–11

This could be an ideal age to explain some ways grown-ups make money, such as:

- By trading time and/or skills for money.

- By running a business of their own.

- By investing enough to live off the profits.

Of course, there are benefits and disadvantages to each of these (like how long it might take to invest enough for option three, or that a business might fail for option two). So, it might be worth investigating these pros and cons together and get them exercising some critical thinking skills.

option three, or that a business might fail for option two). So, it might be worth investigating these pros and cons together and get them exercising some critical thinking skills.

You could put it into practice by encouraging them to turn their hand at money-making for themselves; maximising their chores allowance, or by offering favours for neighbours or family members.

This might also be an apt time to introduce the concept of an emergency fund! The general guidance for most adults is to have three-six months’ worth of savings in an instant access savings account to help them cover emergency costs or in case someone was to ever lose their income.

Even those with income protection insurance would likely need an emergency fund cushion until the policy could start paying out, so it may be worth encouraging them to understand concepts like this.

How insurance works

Ages: 11–12

At this age, they may have seen how long it takes to build up their savings.

Now that they have an understanding of budgeting, how to make more money, and where to hold it — it could be a good time to introduce the idea of protecting their money.

You could give your child an overview of the different types of insurance available:

- Income protection insurance, which adults can use in case of sudden serious ill health, or job redundancy (depending on the policy). If they ever needed it, this insurance would cover them with a set income every month until they find new work, get better, or indefinitely, if their ill health is permanent.

- Buildings and contents; how these protect a home.

- Life insurance; how this financially helps loved ones if something happens.

- Phone insurance (their ears may prick up with this one given their age).

- Bike insurance; which can sometimes be covered as part of a contents insurance policy.

- Travel insurance; explaining this can often include medical cover if an accident happens abroad.

- And, of course, car insurance — which may be worth mentioning is a legal requirement in the UK.

How taxes work

Ages: 12–13

Everybody’s favourite topic — tax.

You could use this time to cover the concept of how tax works, giving income tax as the main example (seeing as it will likely apply to them in life).

Get the calculator out and help them work out how to deduct the basic rate (20%) from their chores allowance, as an example.

E.g. £30 a month, divide by 100 = £0.30 (1%)

Multiply by 80 to see how much they’d get left over if they had to pay 20% income tax.

It’s worth noting that if someone’s income is over certain thresholds, they might become a ‘higher’ (40%) or ‘additional’ (45%) rate taxpayer instead. The best way for them to keep on top of this in the future would be to check the Gov.uk website: https://www.gov.uk/income-tax-rates

Give them the good news too:

You could take this moment to also explain that each person in the UK who pays tax gets a personal allowance (currently it’s £12,570, but this could have changed by the time they are earning — keep up to date by using the same Gov.uk link as above, as this should stay up to date).

During a tax year – April 6th to the following April 5th – they wouldn’t need to pay income tax on the first £12,570 they earn (subject to changing by the time they turn 18).

You could give a general insight into other taxes too and think about introducing ISAs and pensions as tax-efficient options to help them save and invest money when they become an adult.

Your tax treatment will depend on your individual circumstances, and it may be subject to change in the future.

Borrowing and debt

Ages: 13–14

Depending on your own experience of learning about debts and borrowing, you may feel completely averse or totally on board with teaching your kids about this topic.

Consider explaining that borrowing money and temporarily getting into debt would be better viewed as a tool. And understanding how to use it well, would better prevent them from falling into financial trouble.

Some core rules to follow:

- To only borrow what you can afford to pay back.

Most people will have some sort of debt over the course of their lives; what matters is how they manage it and pay it off. Thinking clearly about whether borrowing is truly necessary versus saving up for something counts — especially if they then can’t afford to repay the money based on their budget.

- Understanding the different types of borrowing.

Personal loans, car finance, credit cards (compared to debit cards), even a phone contract.

-

Understanding the importance of never missing a minimum payment.

Although the first rule of this list is key, sometimes someone will borrow money to pay for a big purchase over a longer period of time. However, missing a minimum payment would leave a negative mark on the person’s credit history for the next six years. In those six years, it could make an impact on whether a bank or company would lend money to them, including getting a mortgage in the future.

-

Knowing that mismanaged debts have consequences.

Bankruptcy and bailiffs being the most serious. But another key consideration is the effect that debts that get out of control can have on the person’s mental wellbeing.The Money and Mental Health Policy Institute reported that 46% of people with debt that’s become a problem reporting that they have a mental health condition, and 86% saying their financial situation had made their experiences of mental health worse [2]. This suggests it’s a circular issue and further supports the importance of understanding how to manage debt well to try to prevent this from ever happening to them.

What is a pension pot?

Ages: 14–15

A recent survey by Wealthify found that only 44% of people said they knew what a ‘pension pot’ is — meaning over half couldn’t confidently say they understood one of the most key financial products they’ll have in their lives [4].

As your teenager reaches this age, it may be worth giving them an overview of:

1. What is a pension.

This is an investment account used over the working years of someone’s life which would hopefully grow to an amount of money that they can live off during retirement.

2. The different types available:

The State Pension

Noting this pension alone may not be enough for them to enjoy the retirement they hope for; take a look at the Retirement Living Standards chart here to decide: www.retirementlivingstandards.org.uk

Workplace scheme pensions

Something an employer would set up for them and a minimum of 8% of their monthly income is contributed to. The scheme provider is in charge of how this money is invested though, and individual doesn’t get much say in how their money is being managed (this isn’t right for everyone).

Personal/private pensions

This type of pension can be opened alongside the two mentioned above — or instead of a workplace pension if a person is for example, self-employed and doesn’t have access to one of those. These can offer more flexibility on how and where the money is invested, including options to invest ethically if they’d prefer that.

How mortgages work vs renting

Ages: 16–17

By this age, they may be thinking about leaving the nest in the next few years. This is an opportune time to discuss owning a property vs renting.

Pros of renting:

- It’s usually much cheaper to put a deposit down for rented accommodation compared to getting a mortgage deposit ready. Usually needing 2 months’ worth of rent (one month’s deposit and paying the first month's rent upfront).

- The landlord is responsible for the maintenance and upkeep of the property, rather than themselves.

Cons of renting:

- The money paid in rent goes towards the landlord, not towards paying off their own mortgage.

- By spending their monthly budget on rent, it may take them much longer to save a deposit to get a mortgage in the future.

- They may not be able to decorate it how they want to.

- Tenants may have to share their space with other people.

- It’s possible for the rent deposit to not be returned at the end of the tenancy if there’s been damage to the property (taking photos on day one of moving into a rented property could help with evidence).

- It may not offer a long-term place to call home, as landlords can evict their tenants if they decide to sell the house, etc.

Pros of getting a mortgage/homeownership:

- Every monthly payment paid reduces their own mortgage amount (not going towards a landlord’s mortgage/pocket). Once the mortgage is paid off, their outgoings drop and there’ll be more money in their budget.

- The value of property can go up with renovation, redecorating, or simply appreciating over time.

- You can paint and decorate however you’d like.

- There’s more long-term security when compared to renting.

Cons of homeownership:

- Saving up for the property deposit can take years of saving, 10% of the property cost is a general guide, plus a few thousand pounds more for solicitor’s fees.

- In addition to having the deposit, you need to consider the borrowing power, your credit history, and having what a mortgage lender would consider a stable income. These all play a factor in someone’s mortgage affordability.

- The homeowner is responsible for issues with the property and maintenance. They have to fix things like plumbing issues, a leaky roof, etc.

- If they purchase the ‘leasehold’ of a flat, they might not own the ‘freehold’ of the land beneath it. There may be a service charge or ground rent to pay on top of the mortgage payment, in this case.

Household bills

Ages: 17–18

As they’re now on the cusp of adulthood, you could have an open conversation to hear their thoughts and plans around whether they want to work towards a house deposit first, do an apprenticeship, go off to university, or move into rented accommodation (all depending on your family living situation, of course).

Whatever their plan, it would be time to revisit their budgeting skills to get them ready for adult living costs. You could help them to tweak their budget to suit the 60/30/10 rule, as needed:

- Approximately 60%: Prioritising bills and essential outgoings (food).

- Approximately 30%: Towards a portion of ‘fun’ money/their ‘wants’.

- Approximately 10%: Working towards their financial goals by savings and/or investing.

Remember, these figures are only a general guide. A person’s essential outgoings might be higher than 60%, and if that’s the situation, the other two categories would be reduced to ensure their budgeting doesn’t get them into problem debt.

If you’ve already chatted about emergency funds before now, this could be the perfect moment to put that into play.

It’s generally considered to aim for three to six months of essential outgoings (bills, rent/mortgage, food, etc.) or of someone’s monthly income, if possible[5].

Summary

So, there you have it. An age-appropriate guide for topics to discuss with your child about money and finances.

And while it isn’t exhaustive (other questions about money and financial products may well arise), it hopefully offers you some ideas for key milestones and ways you could incorporate your own family values into their financial education, and key resources to fill any knowledge gaps for yourself before diving in.

Helping to instil good financial habits from a young age could be the bedrock for their own future wealth-building. So, while you’re expanding their knowledge and confidence in financial matters, you could also consider using Wealthify’s Junior Stocks and Shares ISA to help their wealth build in the background — ready for them to access at 18.

As winners of Best Junior ISA from the People’s Money award for six years in a row, we help people build their children’s wealth from birth! Family and friends can be invited to contribute money into the account, with the option of leaving a personalised note to look back on. As well as offering a choice of investment styles managed for you by our in-house team of investment experts.

Find out more here:

With investing, your capital is at risk, so the value of your investments can go down as well as up, which means you could get back less than you initially invested.

Wealthify does not provide advice. If you’re not sure whether investing is right for you, please speak to a financial adviser.

References:

- NCT | Average Childcare Costs

- OECD | International Survey of Adult Financial Literacy (.pdf)

- Money and Mental Health | Money and Mental Health Facts

- Survey conducted amongst 1000 working-age (16-65) pension holders in the UK via 3Gem between 27th June and 1st July 2025.

- Moneyfacts Compare | How to Start Saving an Emergency Fund