Authorised Push Payment fraud (or APP fraud for short) is a modern-day cause for concern.

The Payment Systems Regulator (PSR) reported that 252,626 cases of APP scams were reported in the UK during 2023 alone — coming to almost £341,000,000’s worth of people's hard-earned cash being fraudulently accessed via bank transfers [1].

But as of 7th October 2024, new protections have been put into place to better protect people’s funds [2]. Here’s what you need to know about APP fraud scams, who they impact, and how to prevent them from happening to you:

What is APP fraud?

APP stands for Authorised Push Payment — and it can be a convenient way to transfer money between banks. However, the rise of us using this technology also brings with it a rise in criminals trying to take advantage of both the public and businesses in an attempt to access their money.

Although many of us use ‘apps’ on our mobile phones to access online banking, make payments and use financial services, it isn’t a type of fraud that’s exclusive to mobile phone applications. The definitions aren’t quite the same thing — ‘APP fraud’ is the specific act of someone sophisticatedly tricking you into using a push payment system for them to access your money.

It’s easiest to think about Authorised Push Payments as being when the payer is ‘pushing’ the request to pay for something; this could be a cash payment, a direct deposit, bank transfer, wire transfer, a digital wallet payment [3] or an alternative such as a Buy Now Pay Later scheme [4].

What is an APP scam?

As a crime, fraud has been around for many years. But when we’re discussing Authorised Push Payments, the PSR defines most APP scams as falling into two categories:

1. Malicious payee

e.g. Being tricked into paying for goods that either never arrive, or simply don’t exist.

2. Malicious redirection

e.g. When someone impersonates the staff of your bank to get you to transfer funds from your account into the fraudster’s.

Types of app fraud

Investment scams

These are attempts to trick people or businesses into investing in property, stock, or something similar; however, they either don’t exist or are completely worthless (to everyone except the fraudster who takes the money for their own).

At Wealthify, we have a team of experts tackling and preventing financial crime, as well as a highly qualified Investment Team managing the portfolios of our customers. Every due diligence is performed on the stocks, bonds, and mutual funds that we invest in on our customers’ behalf which are regulated by the Principles for Responsible Investment (UNPRI or PRI).

Romance scams

This type of financial scamming directly impacts people on an emotional level. The scammer is maliciously preying on their victim, forming a deep connection, before asking for money. It could be something quite urgent, like a plea for help during an ‘emergency’, or a long-planned trip to visit the victim (where the latter pays for the costs). Either way, it’s important to be vigilant with your personal finances.

Purchasing/invoice scams (including mandates)

As mentioned above, this type of fraud happens when a scammer tricks their victim into thinking that they are paying for an item or service that doesn’t exist. This may be presented to you that it’s a legitimate seller/service, so stay vigilant!

Advance fee scam

This is when a scammer promises highly valued loans, prize rewards, or goods in exchange for an advanced (or upfront) fee. The scammer will take the money without delivering on their promises.

Impersonations

If you ever receive a call from your bank, or notice unusual correspondence, this could be a classic case of impersonation fraud. (Note: Wealthify would never call you to process a transaction, transfer, or ask for your password.)

CEO messages

A scammer may try to contact a company’s staff member pretending to be the CEO (or senior staff member) requesting a wire or bank transfer. These scams can be very convincing and use a level of urgency as their main leverage.

Who does APP fraud impact?

Anyone who can be deceived into believing a highly sophisticated fraudster! As the most commonly experienced crime that someone in the UK will find themselves a victim of, in England and Wales alone, it accounts for over 40% of crime [5].

Whether it’s an individual person or a business that’s being targeted, these criminals are expert impersonators!

What should I do if I’ve been scammed?

1. Firstly, if you think you’ve been tricked into sending money from your Wealthify account to another account fraudulently, immediately report it to our Customer Care Helpdesk:

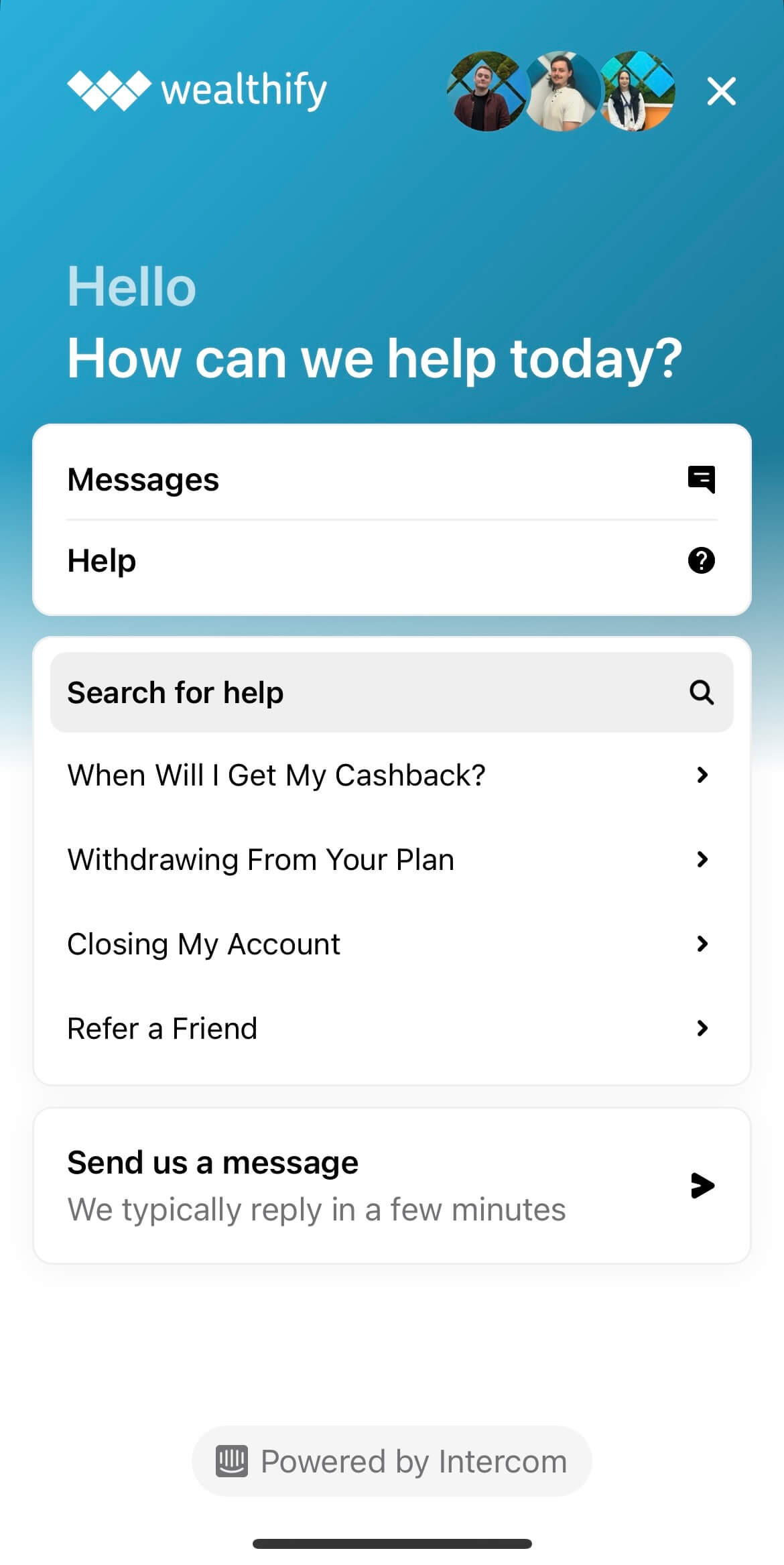

Live Chat and secure messaging: Help centre

Telephone: 0800 802 1800

Our Team are available Monday-Friday, 8am-6:30pm and Saturdays 9am-12:30pm, but if you contact us about an APP fraud outside of these hours, your message will be prioritised as soon as they’re back online.

2. You should also report it to the police. (Action Fraud is the Police’s national fraud reporting centre.)

If the claim is eligible, you should be refunded within 5 working days. However, this may be longer if it’s a complex case (up to 35 days).

A £100 excess could apply (although this wouldn’t apply to anyone deemed to be a vulnerable customer).

APP fraud prevention

Thankfully, under the new APP fraud protection that’s been in place since 7th October 2024, you should now be better protected in the unfortunate event of this happening to you.

That said, criminals are working on new tactics and techniques everyday — so it’s important to stay vigilant.

- Be conscious of how Wealthify (or any bank or business service you use) tells you how they’ll communicate with you. At Wealthify, we would never telephone you to ask you to set up a transfer over the phone, and we will certainly not ask for your password information.

- Never share your password with anyone (not just someone claiming to be Wealthify). And if possible, using biometrics (fingerprint/face recognition security) or a two-step authentication (2FA) can add an additional layer of protection.

- Take advantage of the secure messaging system of your Wealthify app/online dashboard if you’d like to contact us.

- You can also monitor the withdrawals and deposits from your account using the ‘notifications’ settings.

- Always be in control of your accounts and only have email addresses, telephone numbers and other contact details in your name or accessible to you. Do not send any money to an account you do not have control over, even if it's been set up in your name.

- Does that SMS look right? We may send you occasional ‘Push Notifications’ to your phone if you’re an app user, but we don’t send SMS text messages unless it’s a verification code for logging in.

- Always check whether an email address looks accurate, and even when it does, look closer when the sender is asking for you to transfer money — sometimes a scammer could be mimicking an email address. Check if they are using characters that could easily be switched around (i.e. a capital ‘i’ can look like a lowercase ‘l’).

- Making sure our web address has ‘s’ in https://

- And that it ends with ‘wealthify.com’

- And lastly, it’s good practice to have reputable anti-virus software installed.

APP fraud regulations: what steps are being taken to protect individuals

Under the new protection, if you’ve made a payment from a UK bank account to another UK-based account using the Faster Payment Scheme (FPS) or via CHAPS (Clearing House Automated Payment Scheme), you could be eligible to make an APP fraud claim and receive back up to a maximum of £85,000 between the bank sending and receiving any fraudulent transfer. (You may claim within 13 months from the date of the final fraudulent payment.)

More information can be found on the PSR website: www.psr.org.uk/information-for-consumers/our-new-app-fraud-reimbursement-protections/

How Wealthify can help

In addition to the steps laid out above, please know that Wealthify is here to support you during any potential incidents of APP fraud. If you think that you’ve become a victim of an APP fraud, get in touch with our Customer Care Team today!

When logged in use the messaging feature to contact us directly:

When not logged in, you can contact us using our Live Chat, secure messaging feature, or by phone:

Help centre

Telephone: 0800 802 1800

Our Team is available Monday-Friday, 8am-6:30 pm and Saturdays 9am-12:30pm. But, if you notice that an act of fraud has happened outside of those working hours, please let us know anyway and your message will be prioritised as soon as possible. We will do our best to promptly investigate and reimburse your eligible funds.

Finally, please know that you are not alone in a stressful situation such as this. Fraud happens to a great deal of people, and there are organisations that can help you with specific support if you need it:

Victim Support (for further support) and Citizen’s Advice (for guidance of a legal nature).

Sources:

[1]: PSR - PSR publishes latest APP scams performance report for 2023

[2]: PSR - Our new APP fraud reimbursement protections

[3]: ACI Worldwide - App Fraud

[4]: ACI Worldwide - Alternative payment methods

[5]: National Crime Agency - Fraud and economic crime

|