Since Wealthify launched in 2016, we’ve made it our mission to provide easy-to-understand answers, to potentially confusing investment questions.

And, if you’re reading this, chances are you’re looking for an answer to the following conundrum:

Stocks and Shares ISA vs General Investment Account (or GIA vs ISA, for short): what’s the difference between them — and which one is right for me?

Well, the answer to the first part is pretty straightforward; and once you do know the difference, then the second part should become a lot clearer, too.

- What is a Stocks and Shares ISA?

- What is a GIA?

- GIA vs ISA

- Benefits of both

- Considerations

- Can you have a GIA and Stocks and Shares ISA?

- Which one is right for me?

What is a Stocks and Shares ISA?

Ok, let’s start by breaking down the individual terms:

- Stocks and Shares = Units of ownership in a company that can be bought on the stock market.

- ISA = An Individual Savings Account that lets you earn tax-free interest on your savings.

- Stocks and Shares + ISA = A tax-efficient way to invest – and grow – your money by putting it into various companies listed on the stock market.

Naturally, there’s a little bit more to them than that though. You can visit our Stocks and Shares ISA guide to learn more.

What is a GIA?

GIAs offer the same access to markets and investment options as a Stocks and Shares ISA. The big difference, however, is that a GIA doesn't come with the same tax benefits, meaning you have to pay Capital Gains Tax and Income Tax on any profits you make.

As a result, GIAs are generally a good option if you've used your annual ISA allowance for the current tax year — but you still want to carry on investing.

With investing, your capital is at risk. The tax treatment of your investment will depend on your individual circumstances and may change in the future.

GIA vs ISA

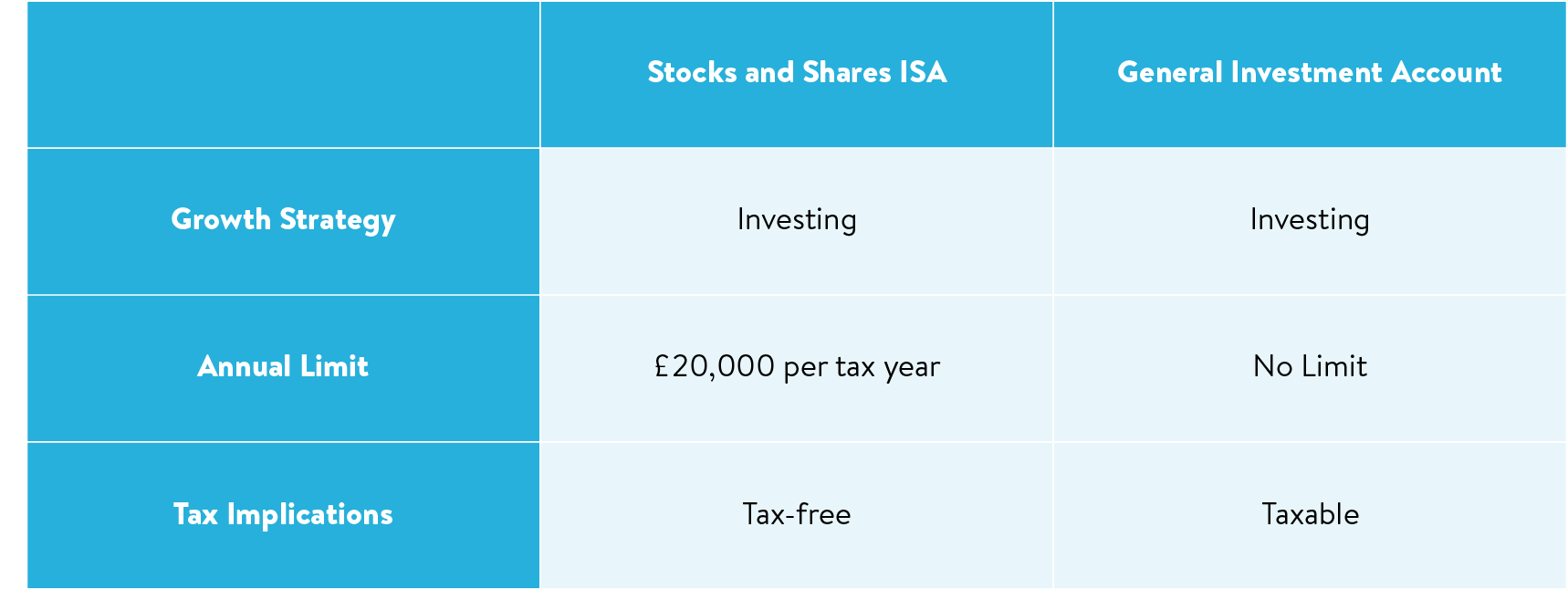

Even though we've outlined the differences in the sections above, we've put them into a table format to make comparing even easier!

Benefits of a Stocks and Shares ISA vs GIA

Because they’re similar, a Stocks and Shares ISA and GIA share certain benefits; each offer a cost-effective way to access stock markets, for example.

Likewise, you can have as much or as little say in how your money’s invested, with DIY and fully-managed versions of both available.

To help decide which one might be right for you, however, it’s important to understand their separate benefits in more detail.

Benefits of a Stocks and Shares ISA

Tax-Free: The biggest benefit is that you don’t have to pay any tax on your earnings, meaning you get to keep more of the returns you make.

Returns: If you want the tax benefits of an ISA but with potentially better returns than a Cash ISA, then a Stocks and Shares ISA could be a good option.

Flexibility: Certain Stocks and Shares ISAs (including Wealthify’s) are flexible, giving you the option to temporarily withdraw money and return it within the same tax year — without using any more of your annual allowance.

Read our benefits of a Stocks and Shares ISA blog

Benefits of a GIA

No Investment Limit: With no cap on how much you can invest, GIAs are a good way to build your investment in the markets.

Annual Exempt Amount: Even though you have to pay Capital Gains Tax on any profits made from a GIA, you do get a tax-free allowance called the ‘Annual Exempt Amount’. For 2024/2025, that figure is £3,000.

Flexibility: Most GIAs give you the flexibility to choose how much and how often you pay in, helping you invest at a pace that suits you.

GIA vs ISA considerations

As ever, it’s not just the benefits you need to consider when it comes to choosing a GIA vs ISA. With a Stocks and Shares ISA, always bear in mind that you can’t save more than £20,000 each tax year (this figure being your annual ISA allowance). But you can spread your allowance across different types of ISAs. For example, you might put £10,000 in a Stocks and Shares ISA, £6,000 in a Cash ISA, and £4,000 in a Lifetime ISA (a Lifetime ISA has an annual £4,000 contribution limit).

Regardless of which one you go for, it’s crucial to check and compare various provider fees, including management and investment charges, and potential withdrawal costs.

Can you have a GIA and Stocks and Shares ISA?

Yes, you can (which means you don't necessarily need to view it as a case of GIA vs ISA, seeing as you can have both). What's more, you can have them with separate providers.

However, only payments into a Stocks and Shares ISA will affect your ISA allowance. So, as there are no limits on how much you can invest in a GIA – and as mentioned previously – they're a good option if you've already used your annual ISA allowance.

GIA vs Stocks and Shares ISA: which one is right for me?

To summarise: there’s no wrong or right answer as it depends on your financial circumstances and goals. As a rule of thumb though:

If you haven't maxed out your annual ISA allowance, it makes sense to take advantage of the tax benefits of a Stocks and Shares ISA first. If – or once – you've used your allowance, then a General Investment Account is a good way to carry on investing (until it resets at the start of the next tax year).

With Wealthify, don't forget we offer a Stocks and Shares ISA and a General Investment Account!

What's more, our Stocks and Shares ISA is flexible, meaning you can temporarily withdraw money and return it within the same tax year — without eating into any more of your annual allowance.

Please remember the value of your investments can go down as well as up, and you could get back less than invested.

The tax treatment depends on your individual circumstances and may be subject to change in the future.

Wealthify does not provide financial advice. Please seek financial advice if you are unsure about investing.