Stocks and Shares ISAs are a tax-friendly way to get into investing, but it’s worth noting that different providers will charge differing fees for the service they provide. Once your wealth builds to a significant amount, you could see your money become increasingly impacted by high fees.

From ongoing management fees to market spread; understanding the fees involved and how they affect your pocket could help you in the long run.

- Stocks and Shares ISA fees

- How fees affect investment returns

- Comparing ISA providers

- How to minimise ISA fees

Stocks and Shares ISA fees

Stocks and Shares ISAs (sometimes called ‘Investment ISAs’) come with some considerations, especially when it comes to fees and applicable charges. While you won’t be paying tax on the money held within them, you will likely have some ongoing fees to contend with.

Your tax treatment will depend on your individual circumstances, and it may be subject to change in the future.

Before committing to a new provider, it’s worth doing some research to find the best-suited ISA for your needs and budget. Here are some things to consider:

Investment fees

These are usually for the buying and selling of your assets. At Wealthify, our investment fees are focused on ‘market spread’, which is the difference between the price we’d buy and sell your investments for. As well as ‘investment costs’ which is taken directly by the fund provider.

We can only estimate this monthly cost, but we try our best to keep it low and affordable for you:

The fees for Ethical Investing Plans are higher because ethical investing requires more active monitoring to ensure that the organisations involved are sticking to their commitments to the environment, social, and governance (ESG) principles they’ve promised. Wealthify’s Investment Team uses a blend of active and passive monitoring for our Ethical Investment Plans, and only works with fund providers that are signatories of the Principles for Responsible Investment (PRI) — ensuring everything is best aligned for our ethically-conscious customers and their values.

Play around with our fees calculator here.

Investment management fees

Management fees cover the ongoing costs for the provider’s work. At Wealthify, we keep our fees as low as possible — charging 0.6% annually, which would be payable on a monthly basis to help you better manage your finances. This fee covers our service and in-house Investment Team’s expertise in managing your Wealthify Investment Plan for you.

Withdrawal and deposit fees

Wealthify doesn’t charge you to deposit or withdraw your money from our Investment Plans, however that doesn’t mean other providers follow suit.

They might include hidden charges to withdraw your money, or even to deposit, so check the fine print of the providers you’re looking at to compare these — as this could be a stinger if you’d planned to make frequent/regular payments in or out.

ISA transfer fees

Another fee-free service from Wealthify — we won’t charge you to transfer your money to us. But again, your current provider might charge you to ‘transfer out’ of their account. Check their terms or contact their customer service team to find out.

And remember, when it comes to transferring ISAs, it’s best to ‘transfer’ using the new provider’s form/official process, rather than withdrawing manually and depositing it with the new provider — this is because the manual withdrawal could affect how much you have remaining of your ISA allowance. A transfer avoids this — letting you keep your full remaining entitlement for the current tax year, and allows you to carry over your tax-free benefits from previous tax years too.

How fees affect investment returns

Compounding

Let’s briefly cover this, first. When you start investing, you may have a relatively low amount of returns. And during this period, compounding may not seem too impactful. But it’s actually pretty powerful over time.

As your profits build (on top of what you’ve personally contributed towards your investment portfolio) these additional returns are reinvested alongside your continued deposits.

With time, as your investments hopefully grow, you’ll start to see this as a significant boost to your portfolio’s value. And once you’ve reached that level, you may want to protect the amount you’ve built up. This is when the difference between high and low fees comes into play.

Higher fees vs lower fees

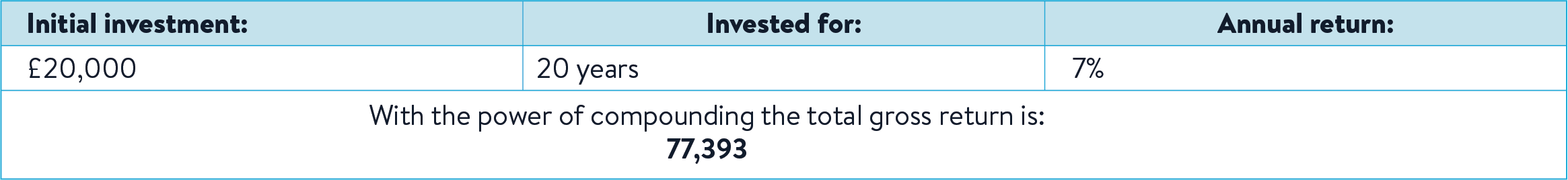

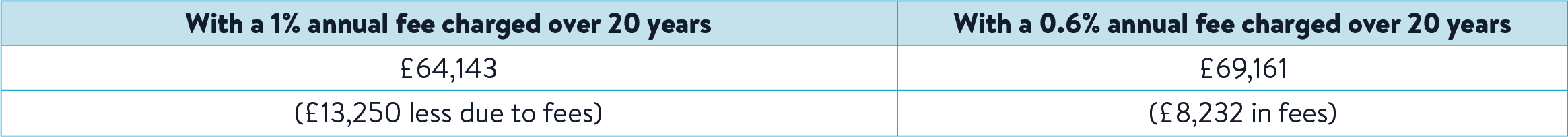

To give you an example of how this could affect your investment returns, let’s say you have the choice between investing £20,000 with a 0.6% annual fee versus a 1% annual fee. Doesn’t seem like much, right? (Keep reading!)

If your annual return is consistently 7%, and you let it mature for 20 years.

This means you’d have £5,018 more in your pocket by paying what feels like a marginal 0.4% difference in fee. Keeping your investment costs as low as possible for the service that you want is considerably important in the long run.

These figures are for example only and not indicative of investing performance; please remember that with investing you could get back less than what you put in.

Comparing ISA providers

There are some key things to consider when you choose which company to have your new Stocks and Shares ISA with, mostly about how the management of your investments works. Do you want to ‘do it yourself’ —which may come with some excitement and control at first, but as investing is something you’d do over many years, you need to decide whether you can commit to that time, research, and monitoring. Or would you prefer an investment expert to do the investing for you in exchange for a fee?

At Wealthify, for example, we’d typically focus on diversifying your investments in different markets across the globe, using a mix of asset types (shares, government bonds, property, small amounts held in cash, etc.) to make sure that you are shielded from any sudden market downturns as much as possible. The Investment Team monitors your portfolio and based on your investment style (Cautious, Tentative, Confident, Ambitious, or Adventurous) will rebalance your investments to keep them in line with your goals and attitude towards investing.

How you go about comparing ISAs confidently is down to you. But whether you prefer to check out the winners of awards, use impartial comparison sites, or ask your friends for their trusted recommendations; once you’ve narrowed down the providers you’re considering, make a simple list of the pros and cons, including:

- Their transparency around fees:

- Account management/platform fees;

- Trading fees (some charge higher if you make frequent sales/purchases);

- Fund management fees (sometimes called ‘ongoing fund charges’ or ‘OCF’ for short);

- Whether there’s a fee to exit or transfer to another provider;

- Any additional charges (e.g. a fee when your investing is considered inactive).

- The minimum amount needed to start investing.

- Whether they have any discounts or current promotions running (if you are asking a friend, they may have a referral code for you to consider.)

Use a list like this to narrow down which provider’s Stocks and Shares ISA is right for you.

How to minimise ISA fees

Here’s a rundown of things you can consider:

- Opt for a low-cost provider;

- Be reflective about how often you trade — there can be higher fees for frequent traders;

- Using bundles of investments like index funds or exchange-traded funds (ETFs) instead of buying individual shares;

- Thoroughly research the market before you decide on a new provider, and if you’re at all unsure, seek independent financial advice.

Conclusion

While it’s true that Stocks and Shares ISA fees will differ from provider to provider, in 2025 you’re in a great position to do online research and have your contending provider’s terms and conditions in just a few taps on your phone.

What’s important is that you find an ISA that’s right for you. At Wealthify, our aim is to help you build your wealth on your terms — putting your investment style and values first and foremost.

Your returns are projected in line with the Investment Plan you’ve selected, how long you intend to invest for, and how compounding will factor in — and with these in mind, our expert Investment Team will manage your portfolio for you for our low fee. Read more about how to get started with our flexible Stocks and Shares ISA here.

Please remember the value of your investments can go down as well as up, and you could get back less than invested.

Your tax treatment will depend on your individual circumstances, and it may be subject to change in the future.

Wealthify does not provide financial advice. Please seek financial advice if you are unsure about investing.