Whether you’re unhappy with your current pension or looking to consolidate past workplace pensions into one easier-to-manage place; shopping around for the most suitable provider is a sensible step.

Self-Invested Personal Pensions (SIPPs) are a way to build your future retirement fund in a more flexible way — particularly when compared to traditional pension schemes, where you have little involvement or decision-making behind how your money is invested.

Transferring your pension to a SIPP could be the solution to having more control over your retirement fund. In this article, we’ll run through some key points before you transfer, why to consider Wealthify for your new Personal Pension, and how exactly to complete a pension transfer.

- Pension transfer considerations

- Why transfer your pension to Wealthify?

- Wealthify reviews

- How to transfer your pension

- Summary

Pension transfer considerations

It can be really frustrating to be unhappy with a pension provider. And paying expensive or unnecessary fees can drain not only you, but your pension’s value, too. But before you make a choice to transfer your pensions to Wealthify, we’d like to point out some important considerations first:

- We can’t accept defined benefit pensions, or any that have safeguarded benefits — like a guaranteed income or where you can get more than 25% of tax-free cash.

- Combining multiple pensions together doesn’t necessarily mean you’ll get a better return (investment performance and market trends can’t be guaranteed).

- We can’t accept any pension you’ve already started withdrawing an income from.

- There’s a period during the transfer when your current assets are sold to transfer to Wealthify in cash. You’ll need to be comfortable with this time ‘out of the market’.

- We don’t charge for transferring into Wealthify, but your current provider may charge an exit fee. Check with them directly before making your decision.

Why transfer your pension to Wealthify?

Your tax treatment will depend on your individual circumstances, and it may be subject to change in the future.

Low and transparent fees

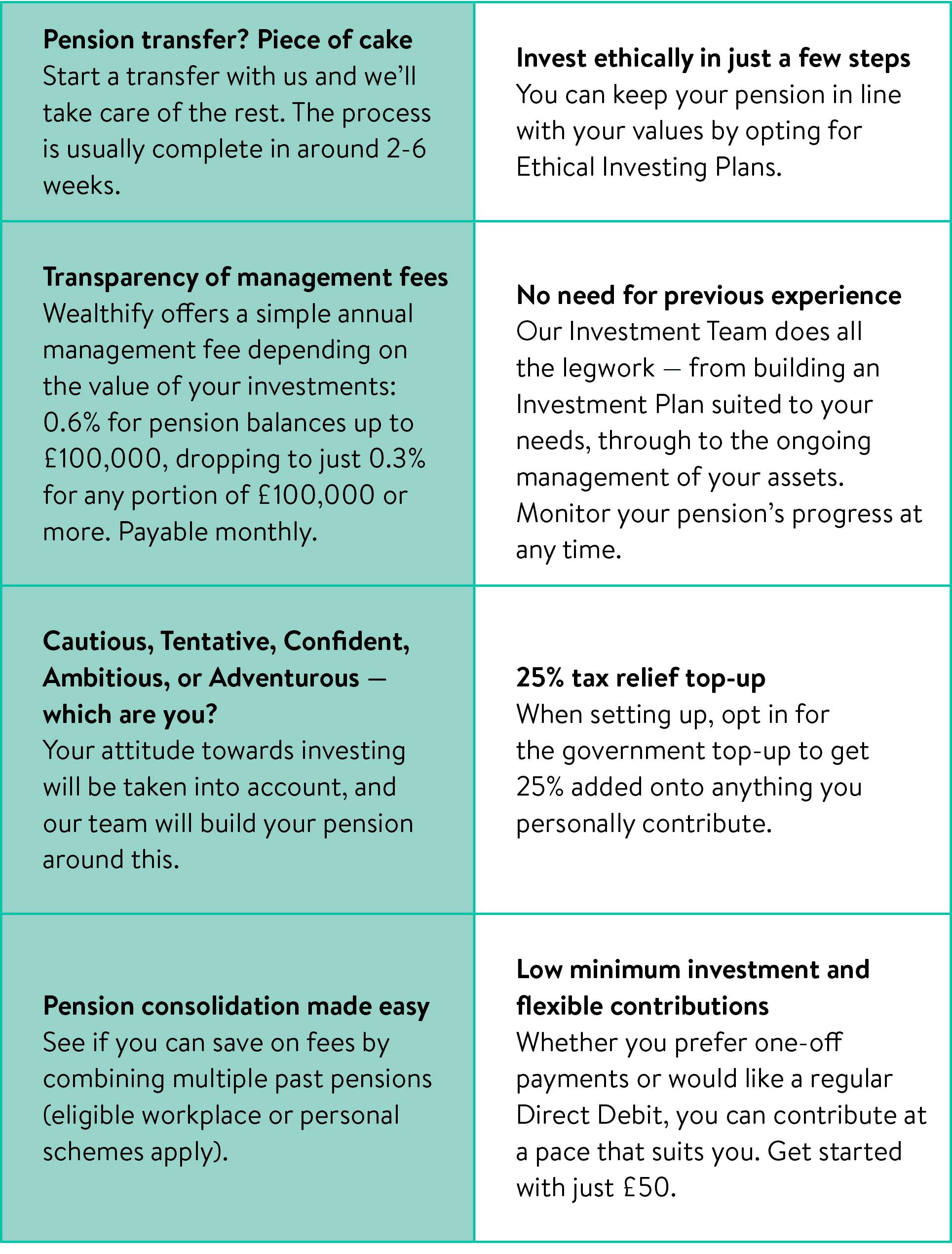

Wealthify keeps fees low: for the management of your portfolio, 0.6% is charged annually, but payable monthly. And for our pension service, this fee drops to 0.3% for any portion that’s £100,000 or above.

There are also investment costs involved: the fund providers we invest with take a small ‘fund charge’, and there’s also ‘market spread’ (which is the cost of buying and selling assets on your behalf). These costs do vary each month, which makes it difficult to give a definitive figure, but we aim to keep them low and transparent for our customers (averaging at 0.16% p.a. for Original Plans and 0.7% p.a. for Ethical — charged annually but payable monthly). Check out our fees page to learn more.

Your fees are deducted directly from your pension fund; you won’t have a separate bill leaving your bank account each month.

Pension consolidation

You could use the opportunity of transferring your pension to Wealthify as a way of combining all your past workplace or personal pensions into one pot.

While there’s no guarantee that pooling them together would give you more money in retirement, many people do prefer to do this for ease of use.

Consolidating your pensions into one pot could also mean that you pay less fees — compare by checking your current provider’s statement to see how much you currently pay. Additionally, SIPPs offer far more flexibility for their owners:

- You can opt for a 25% tax relief top-up on anything you personally contribute to the account (up to a threshold, and you can read more about pension tax reliefs here).

- You can take 25% tax-free lump sums when you reach retirement age (55 years old, rising to 57 by 2028).

- And as the name suggests, you can ‘self-invest' — meaning you get to be more selective over the type of funds the pension is invested in versus a typical workplace pension scheme (where those decisions are made for you). It doesn’t mean you need to be a Wall Street expert yourself though; with Wealthify’s help, our Investment Team can manage your portfolio and that side of things. Just tell us your preferences as you get set up.

Discover how to combine all your old pensions into one pot — visit our pension consolidation page to get started!

Simple pension transfer process

Once you’ve started a transfer with Wealthify, our team will take it from there.

The pension transfer process involves your current provider selling your existing investments and transferring their cash value to us. Once the transfer is complete, our Investment Team will begin building your Pension Plan. This process typically takes between 2-6 weeks.

Ethical investment options

With a Wealthify Personal Pension, you have the option of investing ethically.

If you’ve felt held back from investing because the idea of it didn’t align with your values (or you’re looking for a Self-Invested Personal Pension because you’re dissatisfied with your current provider’s investment choices), then you can explore ethical options with Wealthify.

Investing ethically could make an impact on the environmental, social, or governance issues that matter to you.

Wealthify reviews

Don’t just take our word for it! See what our happy customers are saying about it, too:

How to transfer your pension

Step 1: Set up your SIPP

Visit our Pension Transfer page and follow the ‘Start your transfer’ link. You can then explore our clever Pension Plan features, where you can decide:

- What your pension’s future projected value could be.

- How much and how often you’d like to contribute.

- Whether or not to opt for the 25% tax relief top-up on your personal contributions.

- Your investment style and whether you want to focus on ethical investing only.

There’s a quick suitability quiz as you go along the process, too.

Step 2: Tell us your pension details

You can transfer one or more pensions if you’re looking to consolidate them. To get started, we’ll need to know some information about your existing pension(s), including: The scheme provider’s name; The account reference number; And the approximate value of your pension.

Step 3: Let us take care of the rest

Once you’ve agreed to let us initiate the transfer, we’ll go ahead and contact your existing pension provider for you. Once we have the funds, our Investment Team will start to invest on your behalf to build your new Wealthify Pension Plan.

Summary

So, there you have it: transferring to Wealthify will offer you simplicity, transparency, and affordability.

You could combine your past pensions for ease of use, and this consolidation tactic can be handled by a qualified team of investment experts going forward. Remember: whether you decide to transfer or not, setting yourself the long-term goal of being able to afford the retirement you want, is what counts. So, taking the time to weigh up how your fund is invested in the present-day matters!

Please remember the value of your investments can go down as well as up, and you could get back less than invested.

Wealthify does not provide financial advice. Please seek financial advice if you are unsure about investing.

Your tax treatment will depend on your individual circumstances, and it may be subject to change in the future.

References: